The hydrogen fuel station network expansion is gaining momentum as governments and private companies invest in clean energy infrastructure. This growth is essential for supporting hydrogen-powered vehicles and advancing decarbonization goals across transportation sectors.

Key Takeaways

- Global Growth: Countries like Japan, Germany, and the U.S. are rapidly expanding their hydrogen fuel station networks to support zero-emission mobility.

- Government Support: Subsidies, tax incentives, and national hydrogen strategies are driving infrastructure development and private investment.

- Private Sector Involvement: Energy companies and automakers are partnering to build and operate hydrogen refueling stations.

- Challenges Remain: High costs, limited vehicle availability, and logistical hurdles still slow widespread adoption.

- Future Outlook: With advancing technology and falling production costs, hydrogen stations are expected to become more common by 2030.

- Environmental Impact: Green hydrogen, produced using renewable energy, offers a truly sustainable fuel option when paired with clean refueling infrastructure.

- Regional Hotspots: California, South Korea, and parts of Europe lead in station density and usage, setting models for other regions.

[FEATURED_IMAGE_PLACEHOLDER]

Hydrogen Fuel Station Network Expansion

The world is shifting toward cleaner energy, and hydrogen is emerging as a key player in that transformation. While electric vehicles (EVs) have dominated the headlines, hydrogen fuel cell vehicles (FCEVs) offer a compelling alternative—especially for heavy-duty transport, long-haul trucking, and industrial applications. But for hydrogen-powered vehicles to succeed, they need one critical thing: a reliable network of hydrogen fuel stations.

That’s where the hydrogen fuel station network expansion comes in. Just like gas stations support conventional cars, hydrogen refueling stations are essential for FCEVs to operate efficiently and conveniently. Without a growing network of these stations, even the most advanced hydrogen vehicles can’t reach their full potential. Fortunately, momentum is building. Governments, energy companies, and automakers are investing billions to build out hydrogen infrastructure across the globe.

This expansion isn’t just about convenience—it’s about sustainability. Hydrogen, when produced using renewable energy (known as green hydrogen), emits only water vapor when used in a fuel cell. That makes it a zero-emission fuel option for transportation. As countries aim to meet climate goals and reduce dependence on fossil fuels, hydrogen infrastructure is becoming a strategic priority. From urban centers to highway corridors, new stations are popping up to support a cleaner, more resilient energy future.

The Global Push for Hydrogen Infrastructure

Around the world, nations are recognizing the importance of hydrogen in achieving net-zero emissions. The hydrogen fuel station network expansion is no longer a niche project—it’s a global movement. Countries are rolling out national hydrogen strategies, funding research, and incentivizing private investment to build the infrastructure needed for a hydrogen economy.

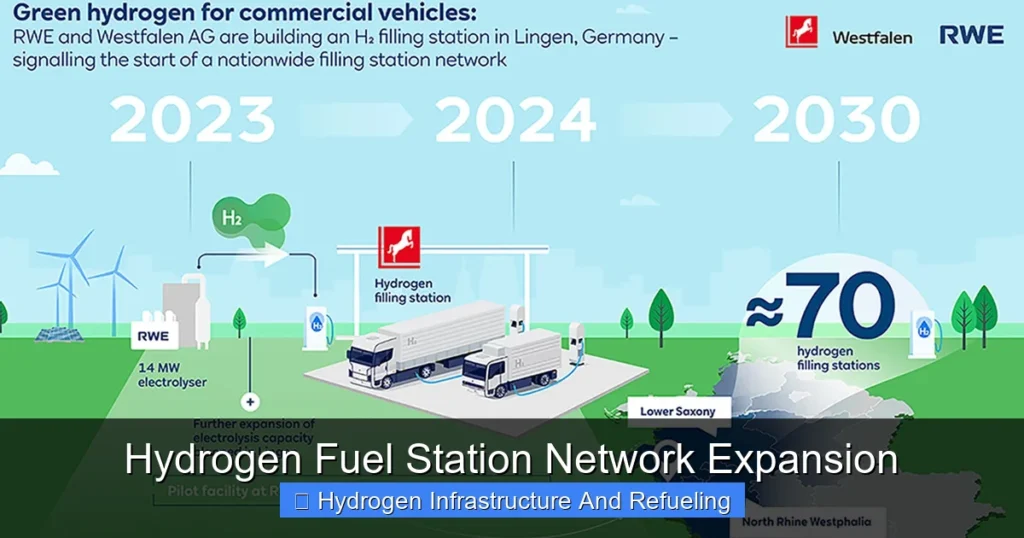

In Europe, the European Union has made hydrogen a cornerstone of its Green Deal. The EU’s Hydrogen Strategy aims to install at least 1,000 hydrogen refueling stations by 2030, with Germany leading the charge. The country already has over 100 stations, the most in Europe, and plans to expand further. France, the Netherlands, and the United Kingdom are also investing heavily in hydrogen infrastructure, focusing on both passenger vehicles and commercial fleets.

Asia is another hotspot for hydrogen development. Japan has long been a pioneer in hydrogen technology, with over 160 hydrogen stations in operation—the highest number in the world. The Japanese government supports this growth through subsidies and partnerships with companies like Toyota and Honda, both of which produce hydrogen-powered vehicles. South Korea is close behind, with a national roadmap targeting 1,200 hydrogen stations by 2040. The country’s automakers, including Hyundai, are major players in FCEV production, creating strong demand for refueling infrastructure.

In the United States, California is the clear leader in hydrogen station deployment. The state has over 60 operational stations, with dozens more in development. The California Energy Commission funds much of this expansion through grants and incentives, aiming to support the state’s goal of 200 stations by 2025. Other states, including New York, Connecticut, and Hawaii, are beginning to follow suit, though progress is slower due to higher costs and lower vehicle adoption.

China, the world’s largest auto market, is also entering the hydrogen race. While still in the early stages, the country has announced plans to build hundreds of hydrogen stations in major cities and along key transportation corridors. The government sees hydrogen as a way to reduce urban air pollution and diversify its energy mix.

Regional Leaders in Hydrogen Station Deployment

Several regions stand out for their aggressive hydrogen infrastructure development. These areas serve as models for others looking to expand their own networks.

California remains the U.S. leader, with a well-established network of hydrogen stations primarily serving the Los Angeles and San Francisco Bay areas. The state’s Zero-Emission Vehicle (ZEV) mandate has driven automakers to produce FCEVs, creating demand for refueling options. Stations are often co-located with existing gas stations or located at fleet depots, making them accessible to both consumers and commercial users.

Germany’s H2 Mobility initiative is a public-private partnership that has built one of the densest hydrogen station networks in Europe. The project involves major energy companies like Linde, Air Liquide, and Shell, as well as automakers such as Daimler and BMW. The goal is to create a nationwide network that supports both passenger cars and heavy-duty trucks.

In Japan, the government’s Basic Hydrogen Strategy outlines a vision for a “hydrogen society,” where hydrogen is used not just in transportation but also in power generation and industry. Stations are strategically placed in urban centers and along major highways, with a focus on safety, efficiency, and public education.

South Korea’s hydrogen roadmap includes not only stations but also hydrogen-powered buses, taxis, and even trains. The city of Ulsan has become a hydrogen hub, with a cluster of production facilities, refueling stations, and research centers.

Government Policies Driving Expansion

Government support is one of the most powerful drivers behind the hydrogen fuel station network expansion. Without policy incentives and funding, the high costs of building and operating hydrogen stations would make widespread deployment nearly impossible.

Many countries have introduced national hydrogen strategies that outline clear goals, timelines, and funding mechanisms. These strategies often include grants for station construction, tax breaks for hydrogen producers, and mandates for zero-emission vehicles. For example, the U.S. Infrastructure Investment and Jobs Act allocates $8 billion to develop regional clean hydrogen hubs, which will include refueling infrastructure.

In the European Union, the REPowerEU plan aims to reduce dependence on Russian gas by accelerating the adoption of renewable hydrogen. Part of this effort includes funding for hydrogen refueling stations, especially along trans-European transport corridors.

Subsidies are another key tool. In California, the Clean Transportation Program provides up to $2 million per station to offset construction costs. Similar programs exist in Germany, Japan, and South Korea. These incentives lower the financial risk for private companies and encourage faster deployment.

Regulatory support also plays a role. ZEV mandates in California and other states require automakers to sell a certain percentage of zero-emission vehicles, including FCEVs. This creates a built-in market for hydrogen stations, as automakers often partner with infrastructure providers to ensure their vehicles have refueling options.

Funding Mechanisms and Incentives

Governments use a mix of direct funding, tax credits, and low-interest loans to support hydrogen infrastructure. These mechanisms help bridge the gap between high upfront costs and long-term profitability.

Direct grants are common in the U.S. and Europe. For example, the U.S. Department of Energy offers funding through its Hydrogen and Fuel Cell Technologies Office. In 2023, the agency awarded millions to projects focused on hydrogen production, storage, and refueling.

Tax incentives can also make a big difference. In the U.S., the Inflation Reduction Act includes a production tax credit for clean hydrogen, which can reduce the cost of hydrogen production by up to $3 per kilogram. This makes green hydrogen more competitive with fossil fuels and supports the business case for new stations.

Low-interest loans and loan guarantees are another option. The European Investment Bank has provided financing for hydrogen projects across the continent, helping to de-risk investments for private developers.

Public-private partnerships are also effective. These collaborations allow governments to share the financial burden with private companies, which bring expertise in construction, operations, and maintenance. For example, Shell and Toyota have partnered on hydrogen stations in California, combining Shell’s energy infrastructure experience with Toyota’s FCEV technology.

Private Sector Investment and Partnerships

While government support is crucial, private companies are the engine behind much of the hydrogen fuel station network expansion. Energy giants, automakers, and startups are investing in hydrogen infrastructure to position themselves for the future of clean transportation.

Major oil and gas companies are pivoting toward hydrogen as part of their decarbonization strategies. Shell, BP, and TotalEnergies are all building or planning hydrogen refueling stations in Europe and North America. These companies see hydrogen as a way to leverage their existing expertise in fuel distribution and retail networks.

Automakers are also key players. Toyota, Honda, and Hyundai have been early adopters of hydrogen technology and are actively supporting infrastructure development. Toyota, for example, has partnered with Air Liquide and others to build stations in Japan and the U.S. The company views hydrogen as a complement to battery electric vehicles, especially for larger vehicles and longer ranges.

Startups are bringing innovation to the space. Companies like Plug Power, Nikola, and Hyzon are developing hydrogen production and refueling solutions tailored for commercial fleets. Plug Power, for instance, operates a network of hydrogen stations in the U.S. primarily serving forklifts and delivery vehicles.

Notable Public-Private Partnerships

Several high-profile partnerships are accelerating hydrogen infrastructure deployment.

In California, the California Fuel Cell Partnership brings together automakers, energy companies, and government agencies to coordinate efforts and share data. This collaboration has helped streamline permitting, reduce costs, and increase station utilization.

In Europe, the H2 Mobility initiative is a consortium of energy and automotive companies working to build a hydrogen network across Germany. The project has already resulted in over 100 stations and plans for continued expansion.

In Japan, the Japan H2 Mobility (JHyM) project includes Toyota, Honda, and major energy firms. The group operates and maintains hydrogen stations, sharing costs and risks to ensure long-term sustainability.

These partnerships demonstrate how collaboration can overcome the challenges of high costs and fragmented markets. By pooling resources and expertise, companies can build stations more efficiently and create a more reliable network for consumers.

Challenges in Expanding the Hydrogen Network

Despite the progress, the hydrogen fuel station network expansion faces significant hurdles. High costs, limited vehicle availability, and logistical challenges slow down deployment and limit accessibility.

One of the biggest barriers is cost. Building a hydrogen station can cost between $1 million and $3 million, depending on size and technology. This is significantly more than a typical EV charging station. The high cost comes from the need for specialized equipment, such as compressors, storage tanks, and dispensers, as well as safety systems to handle high-pressure hydrogen.

Operating costs are also high. Hydrogen is expensive to produce, transport, and store. Even green hydrogen, made with renewable energy, currently costs two to three times more than gasoline on an energy-equivalent basis. This makes hydrogen fuel less attractive to consumers unless prices come down.

Another challenge is the limited number of hydrogen-powered vehicles on the road. As of 2023, there are only about 25,000 FCEVs in the U.S., mostly in California. Without a critical mass of vehicles, stations struggle to achieve high utilization rates, making it harder to justify new investments.

Overcoming Cost and Accessibility Barriers

To address these challenges, stakeholders are exploring several solutions.

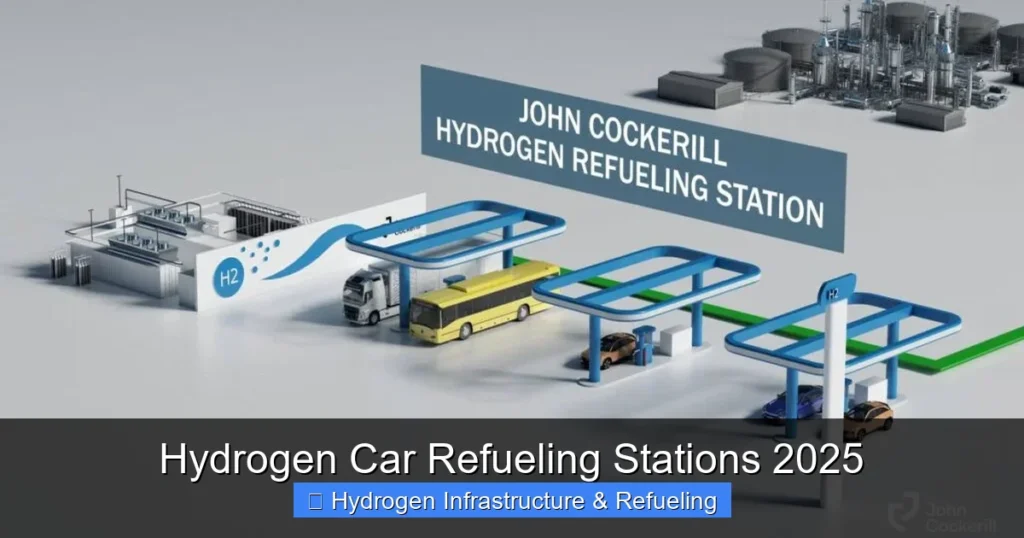

One approach is to focus on high-demand corridors and fleet applications. By targeting areas with high traffic or commercial activity—such as ports, logistics hubs, and major highways—developers can build stations where they’re most likely to be used. For example, hydrogen stations near trucking routes can serve long-haul freight, which is harder to electrify with batteries.

Another strategy is to co-locate hydrogen stations with existing infrastructure. Adding hydrogen dispensers to gas stations or truck stops reduces land acquisition costs and leverages existing customer traffic. Shell has taken this approach in Germany and California, integrating hydrogen into its retail network.

Technology improvements are also helping to lower costs. Advances in electrolysis—the process of splitting water into hydrogen and oxygen using electricity—are making green hydrogen production more efficient. New compressor designs and modular station concepts are reducing construction time and expenses.

Government support remains essential. Continued funding, tax incentives, and regulatory mandates will be needed to sustain the expansion until the market matures and economies of scale kick in.

The Role of Green Hydrogen in Sustainable Refueling

Not all hydrogen is created equal. The environmental benefits of hydrogen fuel depend heavily on how it’s produced. Most hydrogen today is made from natural gas in a process called steam methane reforming, which emits carbon dioxide. This “gray hydrogen” undermines the sustainability goals of clean transportation.

Green hydrogen, produced using renewable electricity to power electrolysis, is the gold standard. It emits no greenhouse gases during production and offers a truly clean fuel option. As the hydrogen fuel station network expands, there’s a growing push to ensure that the hydrogen being dispensed is green.

Countries like Germany and Japan are prioritizing green hydrogen in their national strategies. The European Union requires that hydrogen used in transportation meet strict emissions standards to qualify for subsidies. In the U.S., the Inflation Reduction Act provides higher tax credits for hydrogen produced with low or zero emissions.

Scaling Up Green Hydrogen Production

To support a sustainable hydrogen network, green hydrogen production must scale rapidly. This requires investment in renewable energy—especially wind and solar—and electrolyzer manufacturing.

Countries with abundant renewable resources are well-positioned to become green hydrogen hubs. Australia, for example, is developing large-scale solar and wind projects to produce hydrogen for export. Chile and Morocco are also investing in green hydrogen for both domestic use and international markets.

In the U.S., the Department of Energy’s Hydrogen Shot initiative aims to reduce the cost of clean hydrogen to $1 per kilogram by 2031. Achieving this goal would make green hydrogen competitive with fossil fuels and accelerate station deployment.

Future Outlook: What’s Next for Hydrogen Stations?

The future of the hydrogen fuel station network looks promising, but it will take time, investment, and innovation to reach its full potential. Experts predict that station numbers will grow steadily over the next decade, with the greatest expansion in regions that already have supportive policies and active private sector involvement.

By 2030, countries like Japan, Germany, and South Korea could have thousands of hydrogen stations, supporting not just passenger cars but also buses, trucks, and even trains. The U.S. and China are expected to catch up, driven by climate goals and industrial policy.

Technology will continue to improve. Next-generation stations may offer faster refueling, higher capacity, and integration with renewable energy sources. Some could even produce hydrogen on-site using solar panels or wind turbines, reducing the need for transportation and storage.

As costs come down and vehicle adoption increases, hydrogen could become a viable option for a broader range of transportation needs. While it may never replace battery electric vehicles for passenger cars, hydrogen is likely to play a key role in decarbonizing heavy transport and industrial sectors.

Conclusion

The hydrogen fuel station network expansion is a critical step toward a cleaner, more sustainable transportation future. While challenges remain, the combined efforts of governments, private companies, and innovators are driving real progress. From California to Tokyo, new stations are opening, vehicles are hitting the road, and the vision of a hydrogen-powered world is getting closer.

This expansion isn’t just about building infrastructure—it’s about building a new energy ecosystem. One that prioritizes sustainability, reduces emissions, and offers real alternatives to fossil fuels. With continued investment and collaboration, hydrogen stations could become as common as gas stations are today, powering a new generation of zero-emission vehicles.

The road ahead is long, but the momentum is undeniable. As technology improves and costs decline, the hydrogen fuel station network will continue to grow, bringing us one step closer to a cleaner, greener planet.

FAQs

How many hydrogen fuel stations are there worldwide?

As of 2023, there are over 1,000 hydrogen refueling stations operating globally, with the majority located in Japan, Germany, the U.S., and South Korea. The number is expected to grow significantly in the coming years.

Why is hydrogen infrastructure important for clean transportation?

Hydrogen infrastructure enables the use of fuel cell electric vehicles, which produce zero emissions and offer fast refueling and long range—ideal for heavy-duty and long-haul transport where battery electric vehicles face limitations.

What is green hydrogen, and why does it matter?

Green hydrogen is produced using renewable energy to split water into hydrogen and oxygen. It emits no greenhouse gases and is essential for making hydrogen fuel truly sustainable and climate-friendly.

Are hydrogen fuel stations safe?

Yes, hydrogen stations are designed with multiple safety systems, including leak detection, ventilation, and emergency shutdowns. Hydrogen is lighter than air and disperses quickly, reducing fire risk compared to gasoline.

How much does it cost to build a hydrogen fuel station?

Building a hydrogen station typically costs between $1 million and $3 million, depending on size, technology, and location. Costs are expected to decrease as technology improves and production scales up.

Which countries are leading in hydrogen station development?

Japan, Germany, the U.S. (especially California), and South Korea are the global leaders in hydrogen station deployment, supported by strong government policies and private sector investment.

This is a comprehensive guide about Hydrogen fuel station network expansion.

Key Takeaways

- Understanding Hydrogen fuel station network expansion: Provides essential knowledge

Frequently Asked Questions

What is Hydrogen fuel station network expansion?

Hydrogen fuel station network expansion is an important topic with many practical applications.