Hydrogen fueling stations are expanding rapidly as zero-emission transportation gains momentum. This guide explores the global hydrogen fueling stations map, key regions leading adoption, and how drivers can locate refueling points near them.

Imagine pulling up to a fueling station, stepping out of your car, and filling it with clean, odorless hydrogen gas in under ten minutes. No long charging waits. No range anxiety. Just a quick top-up and you’re back on the road—emissions-free. This isn’t science fiction. It’s happening right now, thanks to the growing network of hydrogen fueling stations around the world.

Hydrogen-powered vehicles, especially fuel cell electric vehicles (FCEVs), are gaining traction as a sustainable alternative to traditional gasoline and even battery-electric cars. While electric vehicles (EVs) dominate the zero-emission conversation, hydrogen offers unique advantages—especially for long-haul trucks, buses, and fleet vehicles that need fast refueling and high energy density. But for hydrogen vehicles to succeed, drivers need access to reliable refueling infrastructure. That’s where the hydrogen fueling stations map comes in.

This map isn’t just a static image. It’s a dynamic, evolving tool that shows where hydrogen is available today and where it’s coming tomorrow. From bustling cities in California to industrial hubs in Germany, the hydrogen refueling network is expanding—slowly, but surely. In this guide, we’ll walk you through everything you need to know about the hydrogen fueling stations map: how it works, where stations are located, how to use it, and what the future holds for hydrogen mobility.

Key Takeaways

- Hydrogen fueling stations are concentrated in select regions: California, Japan, South Korea, and parts of Europe lead in infrastructure development.

- Public and private partnerships drive expansion: Governments and automakers collaborate to build reliable hydrogen networks.

- Mobile apps and online tools help locate stations: Platforms like H2.Live and PlugShare offer real-time station data and availability.

- Refueling is fast and convenient: Hydrogen vehicles can be refueled in under 10 minutes, similar to gasoline.

- Challenges remain in rural and remote areas: Limited coverage outside urban centers affects long-distance travel.

- Future growth is promising: Over 1,000 stations are planned globally by 2030, with major investments in green hydrogen.

- Hydrogen complements electric vehicles: Ideal for heavy-duty transport, buses, and fleet operations where battery weight is a concern.

📑 Table of Contents

Understanding the Hydrogen Fueling Stations Map

The hydrogen fueling stations map is a visual representation of all publicly accessible hydrogen refueling locations across a region, country, or the globe. These maps are typically interactive, allowing users to zoom in, search by location, filter by station status, and even check real-time availability. They serve as essential tools for hydrogen vehicle owners, fleet operators, and policymakers alike.

Unlike gasoline stations, which are nearly everywhere, hydrogen stations are still relatively rare. As of 2024, there are fewer than 1,000 operational hydrogen fueling stations worldwide. But that number is growing fast. The map helps users understand the current landscape and plan routes accordingly. It also highlights areas with high density—like Southern California or Tokyo—and underserved regions that may need investment.

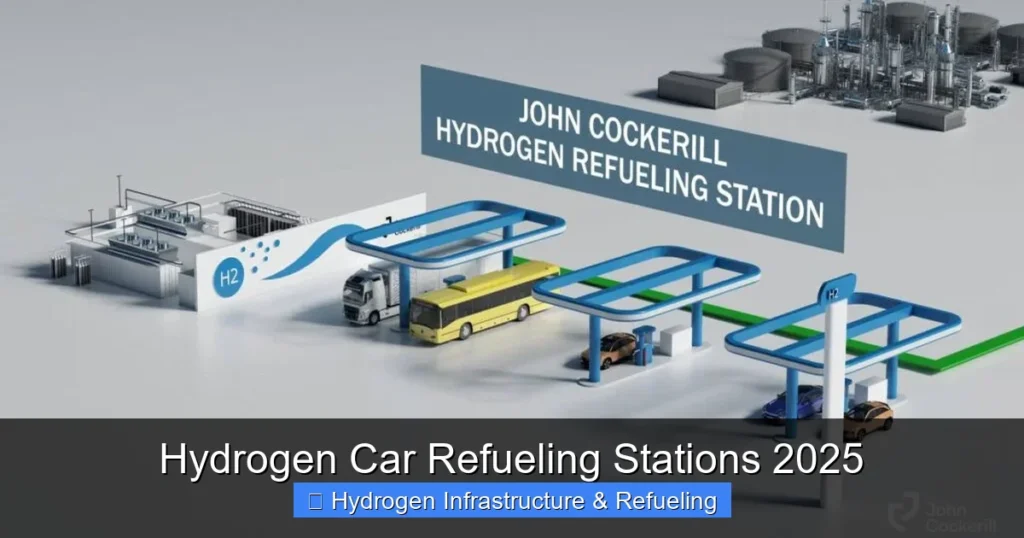

Most hydrogen fueling stations are designed for light-duty vehicles like the Toyota Mirai, Hyundai NEXO, and Honda Clarity Fuel Cell. However, an increasing number support heavy-duty applications, including trucks and buses. The stations use high-pressure dispensers (typically 700 bar) to fill tanks quickly and safely. Some also offer liquid hydrogen, though gaseous hydrogen is more common for passenger vehicles.

How the Map is Built and Updated

Creating and maintaining an accurate hydrogen fueling stations map is no small task. It requires collaboration between station operators, government agencies, automakers, and data platforms. Most maps pull information from multiple sources, including:

– Official station databases from energy companies (e.g., Air Liquide, Shell, Linde)

– Government transportation departments (e.g., California Energy Commission)

– Automaker networks (e.g., Toyota’s H2 station locator)

– Crowdsourced data from drivers using apps

Updates happen regularly—sometimes daily—as new stations open or existing ones undergo maintenance. Some platforms even allow users to report issues like out-of-service pumps or incorrect location data. This real-time feedback loop keeps the map reliable and useful.

One of the most comprehensive global maps is maintained by the International Energy Agency (IEA) through its Hydrogen Projects Database. It tracks not only operational stations but also those under construction or in planning phases. This forward-looking data helps investors and policymakers assess growth trends and identify gaps in coverage.

Types of Hydrogen Stations on the Map

Not all hydrogen stations are the same. The map distinguishes between different types based on technology, ownership, and accessibility:

– Public stations: Open to all hydrogen vehicle owners, often located at retail sites or transit hubs. These are the most common on the map.

– Private or fleet stations: Used exclusively by companies or government agencies (e.g., bus depots, delivery fleets). They may not appear on public maps.

– Mobile refuelers: Temporary units that deliver hydrogen to remote locations or events. Useful for testing or emergency refueling.

– On-site generation stations: Produce hydrogen directly at the location using electrolysis or natural gas reforming. More sustainable if powered by renewable energy.

– Retail-integrated stations: Co-located with gas stations or convenience stores, offering a familiar refueling experience.

Understanding these categories helps users know what to expect. For example, a public station with on-site solar-powered electrolysis is more eco-friendly than one relying on grid electricity. The map often includes icons or labels to indicate these features.

Global Hotspots for Hydrogen Refueling

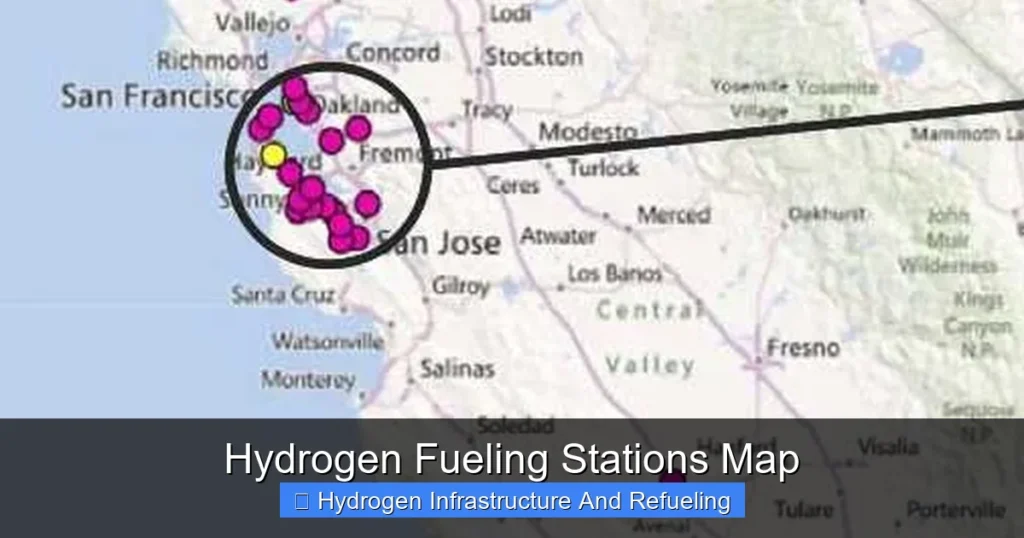

Visual guide about Hydrogen Fueling Stations Map

Image source: c8.alamy.com

While hydrogen fueling stations are still sparse compared to gasoline or EV chargers, several regions have emerged as leaders in infrastructure development. These areas benefit from strong government support, automaker investment, and public awareness. Let’s take a closer look at the top hydrogen hotspots around the world.

California: The North American Leader

California is hands-down the most advanced region for hydrogen refueling in the United States. As of 2024, the state boasts over 60 operational hydrogen stations, with dozens more in development. Most are concentrated in the Los Angeles and San Francisco Bay areas, where FCEVs are most popular.

The California Energy Commission (CEC) has been a major driver of this growth, funding station construction through grants and incentives. Programs like the Clean Transportation Program have invested hundreds of millions of dollars to build a reliable hydrogen network. The goal? 200 stations by 2026 to support 300,000 FCEVs on the road.

Drivers in California can use apps like H2.Live or PlugShare to find the nearest station, check fuel prices, and even reserve a pump. Many stations are open 24/7 and accept credit cards or mobile payments. Some even offer free hydrogen during promotional periods.

One standout example is the True Zero network, operated by FirstElement Fuel. With over 40 stations across the state, True Zero is the largest hydrogen retailer in the U.S. Their stations are sleek, user-friendly, and often located near highways for easy access.

Japan and South Korea: Asian Pioneers

Japan and South Korea are global leaders in hydrogen technology, thanks to strong national strategies and automaker leadership. Japan’s “Basic Hydrogen Strategy” aims to create a hydrogen society by 2050, with over 1,000 stations planned. As of 2024, more than 160 are operational, mostly in Tokyo, Osaka, and Nagoya.

Toyota, the maker of the Mirai, has been instrumental in building Japan’s hydrogen network. The company not only sells FCEVs but also invests in station infrastructure and hydrogen production. In partnership with Iwatani Corporation and others, Toyota has helped deploy stations at dealerships, shopping centers, and public facilities.

South Korea is not far behind. The government has set a target of 1,200 hydrogen stations by 2040. Hyundai, with its NEXO SUV, is a major player, and the country already has over 200 stations in operation. Seoul, Busan, and Incheon are the primary hubs, with stations often integrated into subway stations or bus terminals.

Both countries emphasize green hydrogen—produced using renewable energy—and are investing in hydrogen-powered buses, taxis, and even trains. Their maps are highly detailed, with real-time data and multilingual support for tourists.

Europe: A Patchwork of Progress

Europe’s hydrogen infrastructure is more fragmented, with progress varying by country. Germany, France, and the Netherlands are leading the charge, while others lag behind.

Germany has over 100 hydrogen stations, many part of the H2 Mobility initiative—a joint venture between automakers, energy companies, and the government. The network spans major cities like Berlin, Munich, and Hamburg, with plans to reach 1,000 stations by 2030. Stations are often co-located with existing gas stations, making them easy to find.

France is focusing on hydrogen for heavy transport. With support from the French government and companies like Air Liquide, the country is building corridors for hydrogen trucks along major highways. Paris and Lyon have several public stations, and more are coming online each year.

The Netherlands is a small but mighty player. Despite its size, it has over 20 stations and is investing heavily in hydrogen for maritime and industrial use. Rotterdam, Europe’s largest port, is becoming a hydrogen hub, with plans for large-scale production and export.

Other countries, like the UK and Scandinavia, are also expanding. The UK has around 15 stations, with a goal of 1,000 by 2030. Norway and Sweden are leveraging their abundant renewable energy to produce green hydrogen and support zero-emission ferries and trucks.

How to Use the Hydrogen Fueling Stations Map

Knowing where the stations are is one thing. Knowing how to use them is another. For new hydrogen drivers, the process can feel unfamiliar. But with the right tools and tips, refueling is simple and stress-free.

Finding Stations Near You

The first step is locating a station. Several platforms offer hydrogen fueling stations maps, each with unique features:

– H2.Live: A popular app and website that covers North America and Europe. It shows real-time station status, fuel prices, and user reviews. You can filter by station type, payment method, and availability.

– PlugShare: Known for EV charging, PlugShare also includes hydrogen stations. It’s great for trip planning and has a large user community.

– Hydrogen Council Map: A global overview from the industry group, useful for high-level trends and project updates.

– Automaker Locators: Toyota, Hyundai, and Honda each have their own station finders, often integrated into vehicle navigation systems.

Most of these tools are free and available on smartphones. Simply enter your location or destination, and the map will show nearby stations. Some even suggest the best route based on your vehicle’s range.

Planning Long-Distance Trips

One of the biggest concerns for hydrogen drivers is range anxiety—especially on long trips. Unlike EVs, which can charge at home, hydrogen vehicles must rely on public stations. That’s why route planning is essential.

Start by checking the hydrogen fueling stations map for your route. Look for clusters of stations along highways or in cities you’ll pass through. If there are gaps, consider alternative routes or backup plans.

For example, driving from San Francisco to Los Angeles is straightforward, with multiple stations along Highway 101. But traveling from San Diego to Phoenix? That’s trickier. You’ll need to plan carefully, possibly stopping in Riverside or Palm Springs.

Some apps, like A Better Routeplanner (ABRP), now support hydrogen vehicles. They calculate range, suggest stops, and even factor in weather and elevation. This makes long-distance travel much more manageable.

What to Expect at the Pump

Refueling a hydrogen vehicle is similar to filling up with gas—but with a few key differences. Here’s what to expect:

1. Approach the station: Pull up to the designated hydrogen pump. Most stations have clear signage.

2. Secure the vehicle: Turn off the engine and engage the parking brake.

3. Connect the nozzle: Open the fuel door and attach the dispenser nozzle to the vehicle’s receptacle. It will lock automatically.

4. Start the fill: Follow the on-screen prompts. The system will check for leaks and begin dispensing hydrogen.

5. Wait and monitor: The process takes 3–10 minutes, depending on the tank size and pressure. You’ll see the fill level on the display.

6. Disconnect and go: Once full, the nozzle unlocks. Replace the cap, close the fuel door, and drive away.

Safety is built into every step. Hydrogen is lighter than air and disperses quickly, reducing fire risk. Stations are equipped with sensors, emergency shut-offs, and ventilation systems.

Payment is usually contactless—via credit card, app, or membership card. Some stations offer discounts for frequent users or fleet customers.

Challenges and Limitations

Despite progress, the hydrogen fueling stations map reveals significant challenges. Coverage is uneven, costs are high, and public awareness remains low. Let’s explore the key barriers to wider adoption.

Geographic Gaps

The biggest issue is availability. Outside of California, Japan, and parts of Europe, hydrogen stations are few and far between. Rural areas, small towns, and developing countries have little to no access. This limits the practicality of hydrogen vehicles for many drivers.

For example, while Los Angeles has over 20 stations, neighboring states like Nevada and Arizona have only a handful. Cross-country travel in the U.S. is nearly impossible without careful planning. The same is true in Europe—driving from Berlin to Warsaw might require detours or alternative transport.

These gaps discourage automakers from selling FCEVs in certain markets and make it hard for consumers to justify the switch.

High Costs and Slow ROI

Building a hydrogen station is expensive—typically $1–3 million per location. That’s 10 times more than a fast EV charger. Costs include equipment, safety systems, permitting, and hydrogen supply.

Hydrogen itself is also pricey. In California, it can cost $12–16 per kilogram—enough to drive about 60–70 miles. That’s more than gasoline on a per-mile basis, though less than some EVs when factoring in electricity rates.

Stations struggle to turn a profit due to low vehicle numbers. With only a few thousand FCEVs on the road in most regions, demand is too low to justify investment. This creates a chicken-and-egg problem: no stations, no cars; no cars, no stations.

Lack of Standardization

Unlike gasoline, hydrogen refueling isn’t fully standardized. While most light-duty vehicles use 700-bar gaseous hydrogen, connectors and communication protocols can vary. This can cause compatibility issues, especially with older models or imported vehicles.

Additionally, hydrogen production methods differ. Some stations use “gray” hydrogen from natural gas, which emits CO₂. Others use “green” hydrogen from renewables, which is cleaner but more expensive. The map doesn’t always distinguish between them, leaving drivers unsure about their environmental impact.

The Future of Hydrogen Refueling

Despite the challenges, the future looks bright for hydrogen fueling. Governments, companies, and researchers are working to overcome barriers and accelerate adoption. Here’s what’s on the horizon.

Explosive Growth in Station Numbers

By 2030, experts predict over 1,000 hydrogen stations will be operational globally, with thousands more in development. China, once a laggard, is now investing heavily, aiming for 100 stations by 2025. The U.S. Department of Energy has launched the H2@Scale initiative to support infrastructure.

Major energy companies like Shell, BP, and TotalEnergies are entering the market, bringing capital and expertise. Shell, for example, plans to open 400 hydrogen stations across Europe by 2025.

Green Hydrogen and Renewable Integration

The shift to green hydrogen is critical. Produced via electrolysis using wind, solar, or hydro power, it’s the only truly sustainable option. Countries like Australia, Chile, and Saudi Arabia are developing massive green hydrogen projects, some for export.

Stations will increasingly source green hydrogen, reducing their carbon footprint. Some may even generate it on-site using solar panels or wind turbines.

Expansion Beyond Passenger Vehicles

While FCEVs get most of the attention, the real growth may come from heavy transport. Hydrogen is ideal for trucks, buses, trains, and ships—where batteries are too heavy or slow to charge.

Ports, airports, and logistics hubs are investing in hydrogen refueling for fleets. For example, the Port of Los Angeles is testing hydrogen-powered drayage trucks, with dedicated stations planned.

As these applications scale, demand for hydrogen will rise, making stations more viable and widespread.

Improved Technology and User Experience

Future stations will be smarter, faster, and more user-friendly. Expect features like:

– Mobile app integration for reservations and payments

– Real-time diagnostics and remote monitoring

– Automated refueling (no manual nozzle handling)

– Multi-fuel compatibility (hydrogen, EV, CNG)

Vehicle-to-grid (V2G) technology may also allow hydrogen cars to feed energy back into the grid, turning them into mobile power sources.

Conclusion

The hydrogen fueling stations map is more than just a tool—it’s a window into the future of clean transportation. While the network is still in its early stages, it’s growing rapidly, driven by innovation, investment, and environmental urgency.

For drivers, the map offers peace of mind, helping them find fuel, plan trips, and embrace zero-emission mobility. For policymakers and businesses, it’s a roadmap for infrastructure development and climate action.

Yes, challenges remain. Coverage is uneven, costs are high, and awareness is low. But with continued effort, hydrogen can become a viable option for cars, trucks, and beyond.

As the map fills in—station by station, city by city—the dream of a hydrogen-powered world comes closer to reality. Whether you’re a curious driver, a fleet manager, or a sustainability advocate, now is the time to pay attention. The hydrogen revolution isn’t coming. It’s already here.

Frequently Asked Questions

How many hydrogen fueling stations are there in the world?

As of 2024, there are fewer than 1,000 operational hydrogen fueling stations globally, with the majority located in California, Japan, South Korea, and parts of Europe. The number is expected to grow significantly by 2030.

Can I use any hydrogen station with my fuel cell vehicle?

Most modern FCEVs are compatible with standard 700-bar gaseous hydrogen stations, but it’s best to check your vehicle’s specifications and the station’s compatibility before refueling.

How long does it take to refuel a hydrogen car?

Refueling a hydrogen vehicle typically takes 3 to 10 minutes, similar to filling up a gasoline car, making it much faster than charging most electric vehicles.

Are hydrogen fueling stations safe?

Yes, hydrogen stations are designed with multiple safety features, including leak detection, emergency shut-offs, and ventilation systems. Hydrogen disperses quickly, reducing fire risk.

Where can I find a hydrogen fueling stations map?

You can use apps like H2.Live, PlugShare, or automaker-specific locators from Toyota, Hyundai, and Honda to find real-time hydrogen station locations and availability.

Is hydrogen fuel expensive?

Hydrogen fuel currently costs $12–16 per kilogram in the U.S., which translates to about $0.20–$0.25 per mile—more than gasoline but competitive with some EVs depending on electricity rates.