Hydrogen refueling stations in the EU are expanding rapidly as part of Europe’s clean energy transition. Supported by government policies and private investment, these stations enable zero-emission travel for fuel cell electric vehicles across major corridors and urban centers.

Imagine driving from Berlin to Paris in a quiet, zero-emission vehicle that refuels in minutes—not hours. No plugging in, no range anxiety, just clean hydrogen powering your journey. This isn’t science fiction. It’s the reality slowly taking shape across Europe, thanks to a growing network of hydrogen refueling stations in the EU.

Hydrogen has long been hailed as a promising alternative to fossil fuels, especially for sectors where batteries fall short—like long-haul trucking, public transit, and aviation. While electric vehicles dominate the passenger car market, hydrogen fuel cell vehicles (FCEVs) offer a compelling solution for heavier, longer-range applications. But for hydrogen to succeed, drivers need places to refuel. That’s where hydrogen refueling stations come in.

Across the European Union, governments, energy companies, and automakers are investing heavily in hydrogen infrastructure. From the industrial heartlands of Germany to the wind-swept coasts of Scandinavia, hydrogen refueling stations are popping up along highways, in cities, and near logistics hubs. These stations aren’t just about convenience—they’re a critical piece of Europe’s plan to achieve climate neutrality by 2050.

Key Takeaways

- Hydrogen refueling stations are key to decarbonizing heavy transport and long-haul travel in the EU. Unlike battery-electric vehicles, hydrogen-powered trucks and buses can refuel quickly and travel long distances without weight penalties.

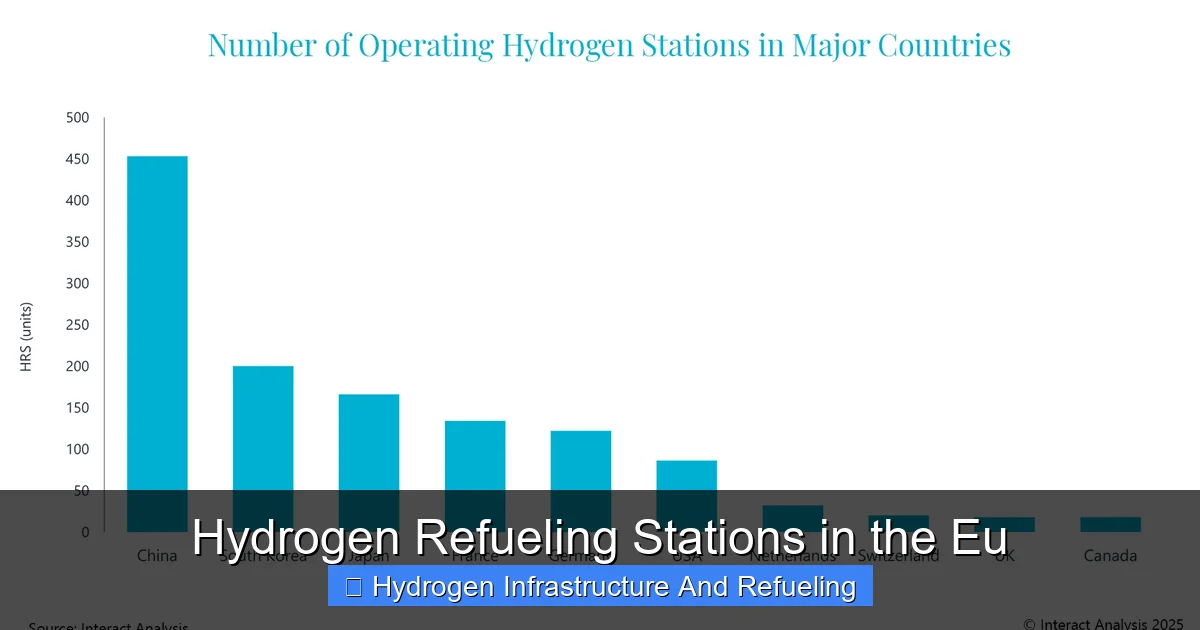

- As of 2024, over 200 hydrogen refueling stations operate across the EU, with Germany leading the way. Countries like France, the Netherlands, and Scandinavia are also making significant progress.

- The EU’s Hydrogen Strategy and REPowerEU plan are accelerating infrastructure development. Billions in public funding and cross-border cooperation are driving deployment along major transport routes.

- Green hydrogen—produced using renewable energy—is the preferred fuel source. Stations are increasingly sourcing hydrogen from electrolysis powered by wind, solar, or hydroelectric power.

- Challenges remain, including high costs, limited vehicle availability, and supply chain bottlenecks. However, innovation and economies of scale are expected to drive down prices over time.

- Public-private partnerships are essential for scaling up the network. Companies like H2 Mobility, Air Liquide, and Shell are collaborating with governments to build reliable, accessible stations.

- Future growth will focus on integration with renewable energy grids and smart refueling systems. This includes on-site hydrogen production and digital platforms for real-time station availability.

📑 Table of Contents

The Rise of Hydrogen in Europe’s Energy Transition

Europe is in the middle of a massive energy transformation. With the European Green Deal setting ambitious climate targets, the EU is pushing hard to phase out fossil fuels and embrace renewable energy. Hydrogen, particularly green hydrogen produced from renewable sources, is seen as a linchpin in this transition.

Unlike gasoline or diesel, hydrogen produces only water vapor when used in a fuel cell. When made using renewable electricity—via electrolysis—it’s completely carbon-free. This makes it ideal for decarbonizing hard-to-abate sectors like heavy industry, shipping, and transport.

The European Commission’s Hydrogen Strategy, launched in 2020, laid out a roadmap for scaling up hydrogen production and infrastructure. The goal? To install at least 6 gigawatts of renewable hydrogen electrolyzers by 2024 and 40 gigawatts by 2030. Alongside production, the strategy emphasizes the need for a robust network of hydrogen refueling stations to support mobility.

Why Hydrogen for Transport?

You might wonder: why hydrogen when electric vehicles are already so popular? The answer lies in use cases where batteries aren’t practical.

Battery-electric vehicles (BEVs) are great for short commutes and city driving. But for long-haul trucking, buses, or even passenger cars that need to travel 500+ kilometers without stopping, batteries become heavy, slow to charge, and expensive. A hydrogen fuel cell vehicle, on the other hand, can refuel in 3–5 minutes and travel up to 800 kilometers on a single tank—similar to a diesel truck.

This makes hydrogen especially valuable for commercial fleets, logistics companies, and public transit systems. Cities like Hamburg, Copenhagen, and Rotterdam are already testing hydrogen-powered buses. Truck manufacturers like Daimler, Volvo, and Nikola are developing hydrogen-powered semis for cross-border freight.

The Role of Policy and Funding

Government support has been crucial in getting hydrogen refueling stations off the ground. The EU’s REPowerEU plan, introduced in 2022 to reduce dependence on Russian fossil fuels, includes €200 billion in funding for clean energy, with a strong focus on hydrogen.

National governments are also stepping up. Germany’s National Hydrogen Strategy allocates €9 billion for hydrogen projects, including refueling infrastructure. France has committed €7 billion, while the Netherlands and Denmark are investing heavily in hydrogen corridors.

These funds support not just station construction, but also research, vehicle subsidies, and workforce training. The goal is to create a self-sustaining hydrogen economy—not just isolated stations, but a connected network that enables seamless travel across borders.

Current State of Hydrogen Refueling Stations in the EU

Visual guide about Hydrogen Refueling Stations in the Eu

Image source: evcandi.com

As of mid-2024, the EU has over 200 operational hydrogen refueling stations. While this number may seem small compared to the 300,000+ electric charging points, it’s a significant leap from just a decade ago. The network is growing fast, with dozens of new stations planned or under construction.

Leading Countries and Regions

Germany is the undisputed leader in hydrogen refueling infrastructure. With more than 100 stations, it has the densest network in Europe. The country’s H2 Mobility initiative—a public-private partnership involving Air Liquide, Linde, Shell, and others—has been instrumental in building stations along major highways and in urban centers like Berlin, Munich, and Stuttgart.

France follows closely, with over 40 stations. Paris, Lyon, and Strasbourg are key hubs, supported by government incentives and partnerships with companies like McPhy and Engie. The French government aims to have 100 stations by 2025.

The Netherlands and Scandinavia are also making strides. The Netherlands has around 30 stations, with a focus on the Randstad region and the port of Rotterdam—a major logistics hub. Denmark and Sweden are investing in hydrogen corridors connecting Copenhagen, Malmö, and Oslo.

Types of Hydrogen Refueling Stations

Not all hydrogen stations are the same. They vary in size, technology, and fuel source.

Retail stations are the most common—similar to gas stations, located along highways or in cities. They serve passenger cars, taxis, and light commercial vehicles. These stations typically store hydrogen in compressed gas form and dispense it at 350 or 700 bar pressure, depending on the vehicle.

Fleet stations are designed for specific users, like bus depots or logistics centers. They often have higher capacity and may include on-site hydrogen production. For example, the city of Hamburg operates a hydrogen bus fleet with a dedicated refueling station powered by wind energy.

Mobile refuelers are temporary or semi-permanent units used for testing, events, or remote locations. They’re useful during the early stages of deployment when demand is low.

Hydrogen Production and Supply

One of the biggest questions about hydrogen refueling stations is: where does the hydrogen come from?

Currently, most hydrogen in the EU is “grey” hydrogen—produced from natural gas, which emits CO₂. But the goal is to shift to “green” hydrogen, made by splitting water using renewable electricity.

Many new stations are designed to use green hydrogen. Some even produce it on-site using electrolyzers powered by solar or wind. For example, the H2Refuel station in Hamburg generates hydrogen from excess wind power and stores it for later use.

Others receive hydrogen via truck or pipeline. Germany and the Netherlands are developing hydrogen pipelines to transport fuel from production sites to refueling stations. This reduces costs and emissions compared to road transport.

Challenges Facing Hydrogen Refueling Infrastructure

Despite progress, hydrogen refueling stations in the EU face several hurdles. Overcoming these challenges is key to scaling up the network.

High Costs

Building a hydrogen refueling station is expensive—typically €1–2 million per unit, compared to €50,000–€100,000 for a fast EV charger. Costs include compression, storage, safety systems, and specialized dispensers.

Hydrogen itself is also costly. Green hydrogen currently costs €5–€8 per kilogram, while grey hydrogen is cheaper but not sustainable. For comparison, diesel costs around €1.50 per liter, and hydrogen vehicles need about 1 kg per 100 km—so fueling a car costs €50–€80 for 500 km.

However, costs are expected to fall as technology improves and production scales up. The EU estimates green hydrogen could reach €2–€3 per kg by 2030.

Limited Vehicle Availability

There aren’t many hydrogen-powered vehicles on the road yet. In 2023, fewer than 5,000 FCEVs were registered in the EU—mostly buses, trucks, and a few passenger models like the Toyota Mirai and Hyundai NEXO.

This creates a chicken-and-egg problem: without enough vehicles, stations struggle to justify their cost. Without stations, consumers are reluctant to buy FCEVs.

To break this cycle, governments are offering incentives. Germany, for example, provides up to €4,000 in subsidies for hydrogen cars and €12,000 for trucks. France and the Netherlands have similar programs.

Technical and Safety Concerns

Hydrogen is highly flammable and requires careful handling. Stations must meet strict safety standards for storage, compression, and dispensing. This adds complexity and cost.

Public perception can also be a barrier. Many people associate hydrogen with the Hindenburg disaster, even though modern systems are much safer. Education and transparency are essential to build trust.

Supply Chain and Skilled Labor

The hydrogen industry is still young, and supply chains are underdeveloped. Components like electrolyzers, compressors, and fuel cells are often imported or produced in small batches.

There’s also a shortage of trained technicians who can install, maintain, and repair hydrogen systems. The EU is investing in vocational training programs to address this gap.

Innovations and Future Developments

The future of hydrogen refueling stations in the EU looks promising, thanks to rapid innovation and strategic planning.

On-Site Hydrogen Production

One of the most exciting trends is on-site production. Instead of transporting hydrogen, stations generate it using renewable energy. This reduces costs, emissions, and reliance on external suppliers.

For example, the Hychico station in the Netherlands uses a 1 MW electrolyzer powered by offshore wind. It produces up to 400 kg of hydrogen per day—enough for 40 buses or 100 cars.

Smart Refueling and Digital Integration

New stations are being equipped with smart systems that optimize refueling based on demand, energy prices, and grid conditions. Drivers can use apps to find nearby stations, check availability, and pay digitally.

Some systems even allow vehicle-to-grid (V2G) interaction, where FCEVs can feed excess energy back into the grid during peak demand.

Hydrogen Corridors and Cross-Border Networks

The EU is developing hydrogen corridors—routes with high-density refueling stations connecting major cities and ports. The Rhine-Alpine corridor, for example, links Rotterdam, Frankfurt, and Milan, supporting freight and passenger travel.

These corridors are part of the Trans-European Transport Network (TEN-T), which aims to create a seamless, zero-emission transport system across Europe.

Integration with Renewable Energy

Hydrogen refueling stations are increasingly being integrated with solar farms, wind parks, and energy storage systems. This creates a closed-loop clean energy ecosystem.

In Denmark, the H2RES project uses excess wind power to produce hydrogen for buses and ferries. The system also stores energy for use during low-wind periods.

The Road Ahead: What’s Next for Hydrogen in the EU?

The next decade will be critical for hydrogen refueling stations in the EU. With strong policy support, falling costs, and growing demand, the network is poised for rapid expansion.

By 2030, the EU aims to have over 1,000 hydrogen refueling stations, serving hundreds of thousands of vehicles. The focus will shift from pilot projects to mass deployment, with an emphasis on affordability, reliability, and sustainability.

Key priorities include:

– Expanding hydrogen corridors across borders

– Increasing the share of green hydrogen

– Reducing station costs through standardization and automation

– Boosting vehicle adoption with incentives and fleet mandates

– Ensuring safety and public acceptance

The ultimate goal is a hydrogen economy that complements electrification, not competes with it. While batteries will dominate passenger cars, hydrogen will power the heavy-duty, long-range, and industrial applications that are hardest to decarbonize.

Conclusion

Hydrogen refueling stations in the EU are more than just fueling points—they’re symbols of a cleaner, more sustainable future. From the bustling ports of Rotterdam to the scenic highways of Scandinavia, these stations are paving the way for zero-emission transport.

Yes, challenges remain. Costs are high, vehicles are scarce, and public awareness is low. But with continued investment, innovation, and collaboration, hydrogen can play a vital role in Europe’s energy transition.

The journey is just beginning. But as more stations open and more vehicles hit the road, one thing is clear: hydrogen is no longer a niche technology. It’s a key part of Europe’s clean mobility future.

Whether you’re a fleet operator, policymaker, or curious driver, now is the time to pay attention. The hydrogen highway is being built—and it’s heading straight toward a greener tomorrow.

Frequently Asked Questions

How many hydrogen refueling stations are there in the EU?

As of 2024, there are over 200 operational hydrogen refueling stations across the European Union. Germany leads with more than 100 stations, followed by France, the Netherlands, and Scandinavia.

Are hydrogen refueling stations safe?

Yes, hydrogen refueling stations are designed with multiple safety systems, including leak detection, pressure relief valves, and fire suppression. Modern hydrogen technology is much safer than older systems, and incidents are extremely rare.

Can I refuel a hydrogen car at any station in the EU?

Not yet. While the network is growing, stations are still concentrated in certain regions. Cross-border travel is possible along hydrogen corridors, but planning is recommended using apps like H2.Live or PlugSurfing.

How long does it take to refuel a hydrogen vehicle?

Refueling a hydrogen car takes about 3–5 minutes—similar to gasoline. This is much faster than charging an electric vehicle, making hydrogen ideal for long trips and commercial use.

Is hydrogen fuel expensive?

Currently, green hydrogen costs €5–€8 per kilogram, which translates to €50–€80 for a 500 km range. Prices are expected to drop to €2–€3 per kg by 2030 as production scales up.

What vehicles can use hydrogen refueling stations?

Hydrogen refueling stations serve fuel cell electric vehicles (FCEVs), including passenger cars (e.g., Toyota Mirai), buses, trucks, and light commercial vehicles. Most stations support both 350 bar and 700 bar dispensing.