By 2025, hydrogen car refueling stations are set to transform clean transportation with faster rollout, improved technology, and growing government support. Major cities and highways will see increased access, making hydrogen-powered vehicles a practical choice for everyday drivers.

Imagine pulling up to a fueling station, connecting a nozzle, and being back on the road in under five minutes—without a drop of gasoline or a long wait for charging. That’s the promise of hydrogen car refueling stations in 2025. As the world races toward cleaner transportation, hydrogen fuel cell vehicles (FCEVs) are emerging as a powerful alternative to battery-electric vehicles (BEVs), especially for long-haul travel, heavy-duty transport, and drivers who value speed and convenience.

Unlike electric cars that require hours to recharge, hydrogen-powered vehicles refuel almost as quickly as traditional gas-powered cars. They emit nothing but water vapor, making them a true zero-emission option. And by 2025, the infrastructure needed to support them is finally catching up. Governments, automakers, and energy companies are investing billions to build out hydrogen refueling networks, particularly in regions with strong climate goals. From California to Germany to South Korea, hydrogen stations are no longer a futuristic dream—they’re becoming a visible part of the transportation landscape.

This shift isn’t just about technology—it’s about changing how we think about clean energy. While battery-electric vehicles dominate the headlines, hydrogen offers unique advantages for certain use cases. For example, long-distance trucking, public transit, and ride-sharing fleets benefit from hydrogen’s quick refueling and long range. And as production methods improve and costs fall, hydrogen is becoming a more viable option for everyday drivers too.

Key Takeaways

- Global expansion accelerating: Over 1,000 hydrogen refueling stations are projected worldwide by 2025, led by Europe, Japan, and the U.S.

- Faster refueling than EVs: Hydrogen cars refuel in 3–5 minutes, matching gasoline convenience while emitting only water.

- Government backing fuels growth: National clean energy plans and subsidies are driving infrastructure investment across key markets.

- Green hydrogen is the goal: Stations are increasingly powered by renewable energy to ensure truly zero-emission fuel.

- Fleet vehicles lead adoption: Trucks, buses, and taxis are early adopters due to high mileage and centralized refueling needs.

- Challenges remain: High costs and limited vehicle availability still slow consumer uptake, but progress is steady.

- Smart tech integration: Mobile apps and real-time station data help drivers locate and reserve hydrogen fuel easily.

📑 Table of Contents

The Global State of Hydrogen Refueling in 2025

By 2025, the hydrogen refueling network has reached a critical tipping point. According to the International Energy Agency (IEA), over 1,000 hydrogen refueling stations are now operational or under construction worldwide—a more than 300% increase from 2020. This growth is not evenly distributed, but key regions are leading the charge.

Japan remains a global leader, with more than 160 stations already in operation and plans to reach 320 by 2025. The country’s “Basic Hydrogen Strategy” has driven consistent investment in both infrastructure and vehicle adoption. Toyota, the maker of the Mirai FCEV, has been a major advocate, partnering with energy firms to build stations across urban centers and along major highways.

South Korea follows closely, with the government aiming for 310 stations by 2025. Hyundai’s NEXO SUV has gained traction, and the country’s dense urban layout makes centralized refueling stations highly efficient. In Europe, Germany leads with over 100 stations, supported by the H2 Mobility initiative—a public-private partnership involving Air Liquide, Linde, and major automakers. France, the UK, and the Netherlands are also expanding rapidly, especially along the Rhine-Alpine corridor, a key freight route.

In the United States, California remains the epicenter of hydrogen infrastructure. As of 2025, the state boasts over 60 operational stations, with another 30 in development. The California Energy Commission has funded much of this expansion through its Clean Transportation Program. Meanwhile, states like New York, Connecticut, and Hawaii are beginning to install their first stations, often in partnership with local utilities and transit agencies.

China, while slower to adopt hydrogen for passenger vehicles, is investing heavily in hydrogen for buses and trucks. Cities like Shanghai, Beijing, and Foshan have launched large-scale pilot programs, with hundreds of hydrogen-powered buses already on the road. The government’s “Made in China 2025” initiative includes hydrogen as a strategic industry, signaling long-term commitment.

Regional Highlights and Milestones

One of the most exciting developments in 2025 is the emergence of hydrogen “corridors”—dedicated routes where drivers can travel long distances with confidence. In Europe, the Rhine-Alpine corridor now features hydrogen stations every 100–150 kilometers, enabling cross-border travel for FCEVs. Similarly, California’s “Hydrogen Highway” stretches from San Diego to the Bay Area, with stations in major cities like Los Angeles, San Jose, and Sacramento.

Japan’s “Hydrogen Society” vision is also taking shape. Stations are integrated into existing gas stations, making them familiar and accessible. Some even offer solar-powered hydrogen production on-site, reducing reliance on external supply chains.

In the U.S., the Department of Energy’s “H2@Scale” initiative is supporting pilot projects in multiple states. For example, a new station in Long Beach, California, uses renewable natural gas to produce hydrogen, cutting emissions by 60% compared to traditional methods. Meanwhile, in Texas, a partnership between Shell and Toyota is testing mobile hydrogen refuelers for fleet operators.

How Hydrogen Refueling Works

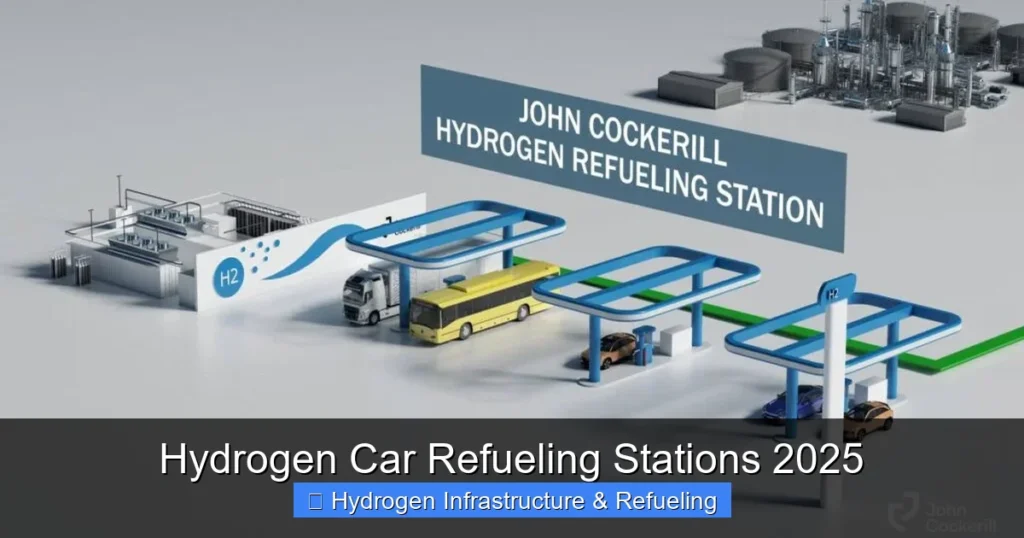

Visual guide about Hydrogen Car Refueling Stations 2025

Image source: pneumaticandhydraulic.com

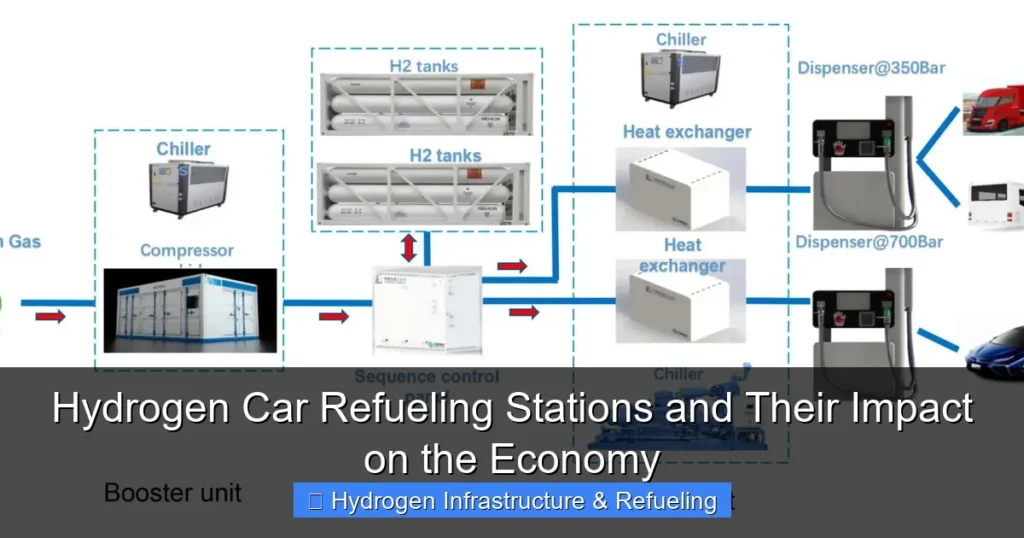

Understanding how hydrogen refueling stations operate can help demystify the technology and ease concerns about safety and efficiency. At its core, the process is simple: hydrogen gas is compressed and stored in high-pressure tanks on the vehicle, then fed into a fuel cell where it reacts with oxygen to produce electricity, powering the motor.

Refueling a hydrogen car is similar to filling up a gasoline vehicle. The driver pulls up to a dispenser, connects a nozzle to the car’s fuel inlet, and initiates the transfer. The entire process takes 3 to 5 minutes, depending on the station and vehicle capacity. Most FCEVs can travel 300–400 miles on a single tank—comparable to many gasoline cars and far exceeding the range of most EVs on a single charge.

The Refueling Process Step-by-Step

1. **Approach and Park:** The driver pulls into the designated hydrogen bay, similar to a gas pump lane.

2. **Grounding and Safety Check:** The station ensures the vehicle is properly grounded to prevent static discharge.

3. **Nozzle Connection:** The driver (or automated system) connects the dispenser nozzle to the car’s fuel port. A secure seal is critical for safety.

4. **Pre-Cooling (Optional):** Some stations pre-cool the hydrogen to -40°C to improve storage efficiency and reduce tank stress.

5. **Filling:** Hydrogen is pumped into the vehicle’s tank at pressures up to 700 bar (10,000 psi). The system monitors pressure and temperature in real time.

6. **Completion and Disconnection:** Once the tank is full, the pump stops automatically. The driver disconnects the nozzle and drives away.

Safety is a top priority. Hydrogen is flammable, but it’s also lighter than air and disperses quickly if leaked. Modern stations include multiple safeguards: gas detectors, emergency shutoffs, flame arrestors, and remote monitoring. In fact, studies show hydrogen refueling is as safe—or safer—than gasoline or diesel.

On-Site vs. Delivered Hydrogen

Not all hydrogen stations produce fuel on-site. Some rely on delivered hydrogen, transported by truck from centralized production facilities. This method is common in early-stage markets where demand is low. However, on-site production is becoming more popular, especially in urban areas.

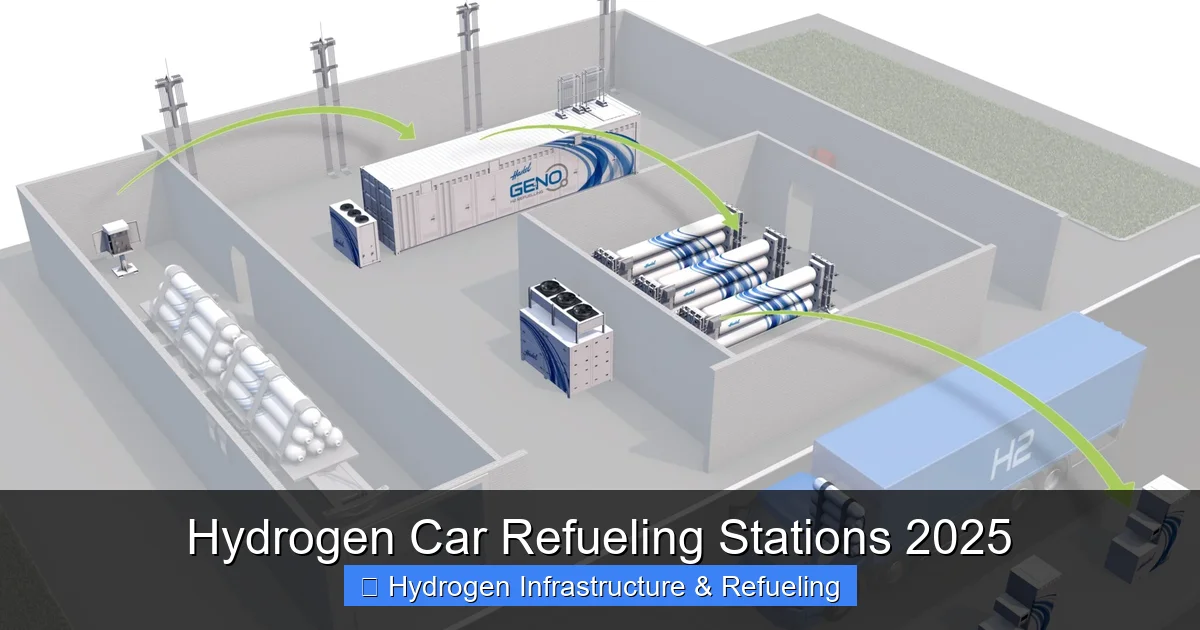

Electrolysis—splitting water into hydrogen and oxygen using electricity—is the cleanest method. When powered by solar or wind, it produces “green hydrogen” with near-zero emissions. Some stations now feature rooftop solar panels or connect directly to renewable grids.

Another method is steam methane reforming (SMR), which uses natural gas to produce hydrogen. While cheaper, it emits CO₂ unless paired with carbon capture. Many stations are transitioning to SMR with carbon capture or blending in green hydrogen to reduce their carbon footprint.

Technology and Innovation Driving Growth

The rapid expansion of hydrogen refueling stations in 2025 is fueled by breakthroughs in technology, materials, and system design. Engineers and companies are solving long-standing challenges around efficiency, cost, and scalability.

One major innovation is the development of compact, modular refueling stations. These units can be installed in urban areas with limited space, such as parking garages or shopping centers. Companies like PowerTap and H2 Energy Now offer skid-mounted systems that can be deployed in weeks, not months.

Smart Refueling and Digital Integration

In 2025, hydrogen stations are getting smarter. Many now feature real-time monitoring, predictive maintenance, and mobile app integration. Drivers can use apps like PlugShare, Hydrogen Station Finder, or manufacturer-specific platforms (e.g., Toyota’s Mirai app) to locate nearby stations, check availability, and even reserve a slot.

Some stations offer contactless payment and automatic billing through vehicle recognition. For fleet operators, this means seamless integration with fleet management systems, reducing downtime and administrative work.

AI is also playing a role. Machine learning algorithms analyze usage patterns to optimize hydrogen production and delivery. For example, a station might increase output during morning rush hour or reduce it overnight, saving energy and costs.

Improved Storage and Compression

Hydrogen’s low energy density by volume has long been a challenge. But new materials and compression techniques are making storage more efficient. Type IV carbon-fiber tanks, now standard in most FCEVs, can withstand extreme pressures while remaining lightweight.

On the station side, advanced compressors reduce energy use by up to 30%. Some systems use hydraulic intensifiers or ionic liquid piston compressors, which are quieter and more reliable than traditional models.

Cryogenic liquid hydrogen is another area of progress. While most stations use gaseous hydrogen, liquid hydrogen offers higher energy density and longer shelf life. A few pilot stations in Germany and Japan are testing liquid refueling for heavy-duty vehicles, which could revolutionize long-haul trucking.

Challenges and Barriers to Adoption

Despite the progress, hydrogen refueling stations still face significant hurdles. High costs, limited vehicle availability, and public skepticism remain key barriers. Understanding these challenges is essential for anyone considering a hydrogen-powered vehicle.

High Infrastructure Costs

Building a hydrogen refueling station is expensive—typically $1.5 to $3 million per unit, compared to $100,000–$500,000 for a fast-charging EV station. Costs include land, equipment, safety systems, and hydrogen production or delivery. This makes it difficult to justify investment in low-demand areas.

However, costs are falling. Modular designs, shared infrastructure (e.g., co-locating with gas stations), and government grants are helping. In California, the state covers up to 75% of station costs through rebates. Similar programs exist in Europe and Japan.

Limited Vehicle Availability

As of 2025, only a handful of hydrogen-powered passenger vehicles are available: the Toyota Mirai, Hyundai NEXO, and the upcoming Honda CR-V Fuel Cell. This limits consumer choice and slows adoption. Most FCEVs are sold in California, Japan, and parts of Europe.

Fleet vehicles are a different story. Hydrogen buses, trucks, and taxis are gaining traction due to their operational advantages. For example, the city of Cologne, Germany, operates over 100 hydrogen buses, refueled at a central depot. In the U.S., companies like Amazon and UPS are testing hydrogen delivery vans in select markets.

Public Awareness and Misconceptions

Many people still associate hydrogen with the Hindenburg disaster, unaware of modern safety standards. Education is key. Automakers and governments are launching campaigns to explain how hydrogen works, its safety record, and its environmental benefits.

Another misconception is that hydrogen is “less green” than batteries. While early hydrogen was often produced from fossil fuels, the shift to green hydrogen is changing that. In 2025, over 30% of hydrogen used in refueling stations comes from renewable sources—a figure expected to rise to 70% by 2030.

The Role of Government and Policy

Government support has been instrumental in the growth of hydrogen refueling infrastructure. Without policy incentives, the high costs and slow returns would deter private investment. In 2025, a combination of funding, regulation, and strategic planning is driving progress.

National Hydrogen Strategies

Over 30 countries have published national hydrogen strategies, outlining goals for production, infrastructure, and adoption. The European Union’s “Hydrogen Strategy for a Climate-Neutral Europe” aims for 40 GW of electrolyzer capacity by 2030. The U.S. has launched the “Hydrogen Shot” initiative, targeting $1 per kilogram of clean hydrogen by 2030.

Japan’s strategy focuses on becoming a “hydrogen society,” importing hydrogen from Australia and Brunei via specialized ships. South Korea is building a hydrogen economy with tax breaks for FCEV buyers and station operators.

Subsidies and Incentives

Financial incentives make a big difference. In California, buyers of new FCEVs receive a $5,000 rebate, plus access to carpool lanes. Station developers can apply for grants covering up to $2 million per project.

In Germany, the government funds up to 80% of station costs through the National Innovation Program for Hydrogen and Fuel Cells. France offers similar support, with a focus on heavy-duty transport.

These programs are not just about building stations—they’re about creating a market. By lowering the barrier to entry, governments encourage automakers to produce more FCEVs and consumers to buy them.

The Future Beyond 2025

Looking ahead, the hydrogen refueling network is poised for exponential growth. By 2030, experts predict over 5,000 stations worldwide, with major expansions in North America, Europe, and Asia. The focus will shift from pilot projects to scalable, self-sustaining systems.

One exciting trend is the integration of hydrogen with other clean technologies. “Hydrogen hubs” are emerging—industrial zones where hydrogen is produced, stored, and used for transport, heating, and power generation. For example, the Port of Rotterdam is developing a hydrogen hub to fuel ships, trucks, and nearby factories.

Another development is the rise of hydrogen-powered aviation and shipping. While still in early stages, companies like Airbus and Maersk are investing in hydrogen fuel cells for planes and cargo ships. If successful, this could create massive demand for refueling infrastructure.

For everyday drivers, the future looks bright. As more automakers enter the market—GM, Ford, and BMW have announced FCEV plans—vehicle choice will expand. And with stations becoming more common, “range anxiety” will fade.

Conclusion

Hydrogen car refueling stations in 2025 represent a pivotal moment in the clean transportation revolution. No longer a niche technology, hydrogen is stepping into the mainstream, supported by global investment, technological innovation, and strong policy backing. While challenges remain, the progress is undeniable.

For drivers, the benefits are clear: fast refueling, long range, and zero emissions. For cities and countries, hydrogen offers a pathway to decarbonize hard-to-electrify sectors like freight and public transit. And for the planet, it’s a crucial tool in the fight against climate change.

As we look to the future, one thing is certain: hydrogen is here to stay. Whether you’re a fleet manager, an eco-conscious driver, or simply curious about the next big thing in mobility, now is the time to pay attention. The road to a hydrogen-powered world is being paved—one refueling station at a time.

Frequently Asked Questions

How long does it take to refuel a hydrogen car?

It takes just 3 to 5 minutes to refuel a hydrogen car—about the same as filling up a gasoline vehicle. This is much faster than charging an electric car, which can take 30 minutes to several hours.

Are hydrogen refueling stations safe?

Yes, hydrogen refueling stations are designed with multiple safety features, including gas detectors, emergency shutoffs, and flame arrestors. Hydrogen disperses quickly if leaked, making it safer than gasoline in many scenarios.

Where can I find a hydrogen refueling station in 2025?

Hydrogen stations are most common in California, Japan, South Korea, and parts of Europe. Use apps like PlugShare or Hydrogen Station Finder to locate the nearest station in real time.

Is hydrogen fuel expensive?

As of 2025, hydrogen costs around $12–$16 per kilogram in the U.S., which is roughly equivalent to $4–$6 per gallon of gasoline. Prices are expected to fall as production scales up.

Can I produce hydrogen at home?

Home hydrogen production is not practical or safe for most people. It requires specialized equipment, high electricity use, and strict safety protocols. Public stations remain the best option.

What vehicles can use hydrogen refueling stations?

Only hydrogen fuel cell vehicles (FCEVs) can use these stations. As of 2025, the Toyota Mirai, Hyundai NEXO, and upcoming Honda CR-V Fuel Cell are the main models available.