Hydrogen fuel cell SUV pricing trends are evolving rapidly as technology advances and production scales up. While currently more expensive than electric and gas-powered SUVs, prices are expected to drop significantly in the coming decade due to innovation and infrastructure growth.

Key Takeaways

- Current prices are high but declining: Hydrogen fuel cell SUVs like the Toyota Mirai and Hyundai Nexo start around $60,000–$70,000, but costs are falling as manufacturing improves.

- Government incentives reduce upfront cost: Federal and state tax credits, rebates, and HOV lane access can lower the effective price by $10,000 or more.

- Fuel costs vary by region: Hydrogen fuel prices range from $12–$16 per kilogram, making refueling comparable to premium gasoline in some areas.

- Infrastructure limitations affect adoption: Limited hydrogen stations, mostly in California, restrict widespread use and influence pricing strategies.

- Long-term savings on maintenance: Fewer moving parts mean lower repair and maintenance costs over the vehicle’s lifetime.

- Future models will be more affordable: Automakers plan to launch mid-priced hydrogen SUVs by 2030, targeting the $40,000–$50,000 range.

- Environmental benefits add value: Zero tailpipe emissions and fast refueling make hydrogen SUVs a compelling green alternative.

📑 Table of Contents

- Introduction to Hydrogen Fuel Cell SUVs

- Current Market Overview and Pricing Landscape

- Factors Influencing Hydrogen Fuel Cell SUV Pricing

- Future Pricing Trends and Market Projections

- Comparing Hydrogen SUVs to Electric and Gas-Powered Alternatives

- Environmental and Practical Benefits

- Conclusion: The Road Ahead for Hydrogen SUVs

Introduction to Hydrogen Fuel Cell SUVs

Imagine pulling up to a fueling station, filling your SUV in under five minutes, and driving 300–400 miles on a single tank—all while emitting nothing but water vapor. That’s the promise of hydrogen fuel cell SUVs. These vehicles use hydrogen gas to generate electricity through a chemical reaction in a fuel cell stack, powering an electric motor without burning fossil fuels. Unlike battery-electric SUVs, which can take hours to recharge, hydrogen SUVs offer the convenience of quick refueling, making them ideal for long-distance travel and heavy-duty use.

But here’s the catch: they’re still relatively rare and expensive. As of 2024, only a handful of hydrogen fuel cell SUVs are available to consumers, primarily in select markets like California. The technology is promising, but high production costs, limited infrastructure, and low consumer awareness have kept prices elevated. However, that’s starting to change. Automakers are investing heavily in hydrogen technology, and governments are supporting clean energy initiatives. As a result, hydrogen fuel cell SUV pricing trends are shifting—slowly but surely—toward greater accessibility.

Current Market Overview and Pricing Landscape

Right now, the hydrogen fuel cell SUV market is niche but growing. The two most prominent models available in the U.S. are the Toyota Mirai and the Hyundai Nexo. Both are midsize luxury SUVs designed with cutting-edge technology and eco-friendly performance in mind.

The Toyota Mirai starts at around $60,000 for the base model, with the higher-end XLE trim pushing closer to $70,000. The Hyundai Nexo is similarly priced, with the Blue trim starting near $60,000 and the Limited version reaching about $68,000. These prices place them firmly in the premium segment, competing with luxury electric SUVs like the Tesla Model X and the Audi e-tron.

So why are they so expensive? Several factors contribute. First, the fuel cell stack itself is complex and costly to produce. It requires rare materials like platinum as a catalyst, which drives up manufacturing expenses. Second, hydrogen storage systems must be highly durable and safe, using advanced carbon-fiber tanks that can withstand high pressure. Third, low production volumes mean economies of scale haven’t yet kicked in. Automakers are still building these vehicles in small numbers, which keeps per-unit costs high.

But there’s good news: prices are trending downward. Toyota, for example, has reduced the cost of the Mirai by nearly 30% since its first generation launched in 2016. The second-generation Mirai, introduced in 2021, uses a more efficient fuel cell system and lighter materials, helping to lower both production and retail costs. Hyundai has also made strides with the Nexo, improving range and performance while maintaining a competitive price point.

Regional Price Variations

Pricing isn’t the same everywhere. In the U.S., hydrogen fuel cell SUVs are primarily sold in California, where the majority of hydrogen refueling stations are located. This geographic concentration allows automakers to offer special incentives, such as free hydrogen fuel for three years—a perk that effectively reduces the total cost of ownership.

Outside California, availability is extremely limited. States like New York and Hawaii have a few stations, but most of the country has no hydrogen infrastructure at all. As a result, manufacturers often don’t sell these vehicles in other regions, or they offer them only through special-order programs with higher delivery fees.

In other parts of the world, the picture is mixed. Japan and South Korea have strong government support for hydrogen vehicles, with subsidies and tax breaks that make them more affordable. In Europe, countries like Germany and France are investing in hydrogen infrastructure, and automakers like BMW and Mercedes-Benz are developing hydrogen SUVs for future release. However, pricing remains high across the board, with European models often costing €70,000 or more.

Leasing vs. Buying: A Smart Financial Move

Given the high upfront cost, many consumers are turning to leasing instead of buying. Both Toyota and Hyundai offer attractive lease deals on their hydrogen SUVs. For example, the Mirai is available for around $350–$450 per month with $3,000–$5,000 due at signing. These leases often include free hydrogen fuel for the duration of the contract, which can save thousands of dollars over three years.

Leasing makes sense for several reasons. First, it lowers the monthly payment, making the vehicle more accessible. Second, it protects consumers from rapid depreciation—hydrogen SUVs currently lose value faster than traditional vehicles due to limited resale markets. Third, it allows drivers to experience the technology without a long-term commitment, which is wise given how quickly the industry is evolving.

For those who prefer to buy, financing options are available through dealerships and third-party lenders. However, interest rates may be higher than for conventional vehicles, and down payments are typically larger due to the higher purchase price.

Factors Influencing Hydrogen Fuel Cell SUV Pricing

Understanding why hydrogen fuel cell SUVs cost what they do requires a closer look at the underlying factors. It’s not just about the vehicle itself—it’s about the entire ecosystem, from raw materials to infrastructure.

Production Costs and Material Expenses

The heart of a hydrogen fuel cell SUV is the fuel cell stack, where hydrogen and oxygen combine to produce electricity. This process requires a catalyst, and for many years, that catalyst was platinum—a rare and expensive metal. While newer designs are reducing platinum usage, it still adds significant cost.

Additionally, hydrogen must be stored on board under high pressure—typically 700 bar—which requires reinforced carbon-fiber tanks. These tanks are lightweight but costly to manufacture. Each tank can cost thousands of dollars, and most SUVs use multiple tanks to achieve a usable range.

Battery systems also play a role. While hydrogen SUVs generate their own electricity, they still use a small lithium-ion battery to handle peak power demands and store energy from regenerative braking. This battery is smaller than in a full EV, but it still adds to the overall cost.

Research, Development, and Low Volume Production

Hydrogen fuel cell technology is still in its early stages compared to internal combustion engines or even battery-electric systems. Automakers have invested billions in R&D to make these vehicles safe, efficient, and reliable. These development costs are spread across a small number of units, driving up the per-vehicle price.

For example, Toyota has spent over $1 billion on hydrogen technology since the 1990s. While some of that investment has paid off in other areas—like the success of the Prius hybrid—the Mirai remains a low-volume product. In 2023, Toyota sold fewer than 3,000 Mirai units in the U.S., compared to over 200,000 for the RAV4.

Hyundai faces a similar challenge. The Nexo is built on a specialized platform, which limits production flexibility and increases costs. Until demand grows, automakers can’t justify mass production, which keeps prices high.

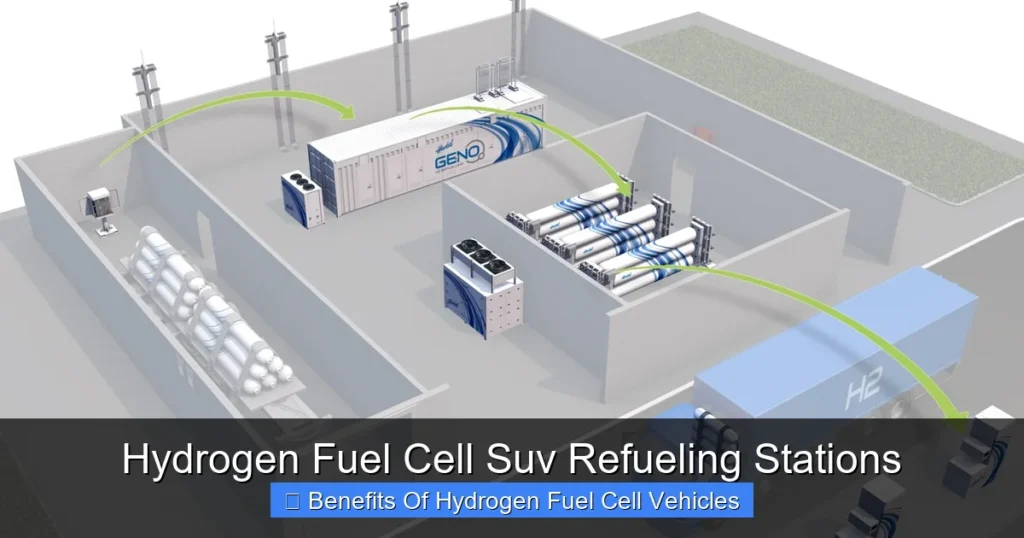

Infrastructure and Distribution Challenges

One of the biggest barriers to lower pricing is the lack of hydrogen refueling infrastructure. As of 2024, there are fewer than 100 public hydrogen stations in the U.S., with over 80% located in California. Building a hydrogen station costs between $1 million and $3 million, and many are subsidized by state governments.

This limited infrastructure affects pricing in several ways. First, automakers must limit sales to areas with stations, reducing market size and economies of scale. Second, they often include free fuel as an incentive, which is factored into the vehicle’s price. Third, the cost of transporting hydrogen—often by truck from centralized production facilities—adds to the overall expense.

Distribution is another issue. Hydrogen SUVs are typically shipped from manufacturing plants in Japan or South Korea, adding import fees and logistics costs. Dealerships in non-California states may not even stock them, requiring special orders that take weeks or months to fulfill.

Government Policies and Incentives

Government support plays a major role in hydrogen fuel cell SUV pricing. In the U.S., the federal government offers a tax credit of up to $8,000 for fuel cell vehicles, though this credit is set to phase out once manufacturers reach 200,000 eligible sales—a threshold Toyota and Hyundai have not yet reached.

California offers even more generous incentives. The Clean Vehicle Rebate Project (CVRP) provides up to $5,000 for new hydrogen fuel cell vehicles. Additionally, owners can apply for a Clean Air Vehicle decal, allowing them to use carpool lanes regardless of passenger count—a valuable perk in congested areas.

Other states, like New York and Colorado, have smaller rebate programs, but they’re growing. At the federal level, the Inflation Reduction Act includes funding for clean hydrogen production and infrastructure, which could lower costs in the long run.

Internationally, countries like Japan and Germany offer substantial subsidies. In Japan, buyers can receive up to ¥3 million (about $20,000) toward the purchase of a hydrogen vehicle. Germany has a €9,000 incentive for fuel cell cars, and France offers similar support.

These incentives significantly reduce the effective price for consumers, making hydrogen SUVs more competitive with luxury EVs and hybrids.

Future Pricing Trends and Market Projections

The future of hydrogen fuel cell SUV pricing looks promising. Experts predict that prices will drop significantly over the next decade as technology improves and production scales up.

Technological Advancements Driving Down Costs

One of the biggest cost drivers—the fuel cell stack—is becoming cheaper to produce. Researchers are developing catalysts that use less platinum or alternative materials like iron-nitrogen-carbon compounds. These new catalysts are not only less expensive but also more durable, extending the life of the fuel cell.

Manufacturers are also improving efficiency. The latest fuel cell systems convert over 60% of hydrogen’s energy into electricity, up from around 40% in early models. This means less fuel is needed for the same range, reducing operating costs and making the technology more appealing.

Battery technology is advancing too. While hydrogen SUVs don’t rely on large batteries, even small improvements in energy density and cost can help reduce overall vehicle expenses.

Economies of Scale and Increased Production

As demand grows, automakers will be able to produce hydrogen SUVs in larger volumes, spreading fixed costs over more units. Toyota, for example, is building a new fuel cell production line in Kentucky, which will increase output and reduce per-unit costs.

Hyundai has announced plans to expand hydrogen vehicle production across its lineup, including SUVs, trucks, and buses. The company aims to produce 700,000 fuel cell systems annually by 2030, which could bring down prices across the board.

New entrants are also entering the market. BMW is developing a hydrogen version of the X5, expected to launch in limited numbers by 2025. Mercedes-Benz has tested a hydrogen GLC, and General Motors is partnering with Honda to develop fuel cell systems for future vehicles.

As more models become available, competition will drive prices down. Consumers will have more choices, and automakers will need to offer better value to stand out.

Projected Price Drops by 2030

Industry analysts estimate that hydrogen fuel cell SUVs could cost 30–40% less by 2030. That would bring the average price down to the $40,000–$50,000 range, making them competitive with mid-tier luxury EVs and high-end hybrids.

Several factors will contribute to this decline:

– Reduced material costs (especially platinum)

– Higher production volumes

– Improved manufacturing efficiency

– Government support for clean energy

– Expansion of hydrogen infrastructure

For example, if the next-generation Toyota Mirai uses a 50% smaller platinum catalyst and is produced at five times the current volume, the price could drop to around $45,000. Hyundai’s future models might follow a similar trajectory.

The Role of Green Hydrogen

Another key factor is the shift toward “green hydrogen”—hydrogen produced using renewable energy like wind and solar. Currently, most hydrogen is made from natural gas, which emits carbon dioxide. Green hydrogen is cleaner but more expensive.

However, as renewable energy costs fall and electrolyzer technology improves, green hydrogen is becoming more affordable. Countries like Australia, Chile, and Saudi Arabia are investing heavily in green hydrogen production, which could lower fuel costs and make hydrogen SUVs more sustainable and economical.

Comparing Hydrogen SUVs to Electric and Gas-Powered Alternatives

When evaluating hydrogen fuel cell SUV pricing, it’s important to compare them to other types of vehicles. How do they stack up against battery-electric SUVs (BEVs) and traditional internal combustion engine (ICE) SUVs?

Upfront Cost Comparison

Hydrogen SUVs are currently the most expensive option. A new Mirai or Nexo costs about $60,000–$70,000, while a comparable Tesla Model Y starts around $50,000 and a gas-powered Lexus RX 350 starts near $50,000.

However, incentives can narrow the gap. With federal and state rebates, the effective price of a hydrogen SUV can drop to $50,000 or less. Leasing deals also make monthly payments similar to those of premium EVs.

Fuel and Operating Costs

Hydrogen fuel costs about $12–$16 per kilogram. A typical hydrogen SUV gets about 60–70 miles per kilogram, so a full tank (around 5–6 kg) costs $60–$90 and delivers 300–400 miles of range. That’s comparable to filling a premium gas SUV, which might cost $70–$100 for a similar range.

Electric SUVs are cheaper to “fuel.” Charging a Tesla Model Y at home costs about $0.15 per kWh, and the vehicle gets around 4 miles per kWh. That means a 300-mile charge costs about $11.25—far less than hydrogen.

However, hydrogen wins on refueling time. A 5-minute fill-up beats the 30–60 minutes needed for a fast charge, especially on long trips.

Maintenance and Longevity

Hydrogen SUVs have fewer moving parts than gas vehicles, so maintenance is simpler. No oil changes, no spark plugs, no exhaust system repairs. The fuel cell stack is designed to last 100,000–150,000 miles, and the electric motor is highly durable.

Battery-electric SUVs also have low maintenance costs, but battery degradation can be a concern over time. Hydrogen SUVs don’t face this issue, as the fuel cell doesn’t store energy—it generates it on demand.

Gas-powered SUVs require regular maintenance and are more prone to mechanical issues. Over 10 years, the total cost of ownership for a hydrogen or electric SUV is likely lower than for a gas vehicle, even with higher upfront costs.

Environmental and Practical Benefits

Beyond pricing, hydrogen fuel cell SUVs offer compelling benefits that add long-term value.

Zero Tailpipe Emissions

Hydrogen SUVs emit only water vapor, making them truly zero-emission vehicles. This is a major advantage in cities with air quality concerns and for drivers who want to reduce their carbon footprint.

While battery-electric vehicles also have zero tailpipe emissions, the electricity used to charge them may come from fossil fuels. Hydrogen, especially green hydrogen, offers a cleaner alternative when produced sustainably.

Fast Refueling and Long Range

One of the biggest drawbacks of electric SUVs is charging time. Even with fast chargers, it takes 30 minutes or more to reach 80% capacity. Hydrogen SUVs can be refueled in under 5 minutes, just like a gas vehicle.

They also offer longer range—typically 350–400 miles—compared to many EVs, which often max out around 300 miles. This makes hydrogen SUVs ideal for road trips, rural driving, and commercial use.

Quiet and Smooth Driving Experience

Like electric vehicles, hydrogen SUVs are quiet and provide instant torque. The ride is smooth and responsive, with no engine noise or vibration. This enhances comfort, especially on long drives.

Conclusion: The Road Ahead for Hydrogen SUVs

Hydrogen fuel cell SUV pricing trends are moving in the right direction. While current models are expensive, a combination of technological innovation, government support, and increasing production volumes is driving costs down. By 2030, we could see hydrogen SUVs priced competitively with luxury EVs and hybrids, making them a viable option for more consumers.

The benefits—zero emissions, fast refueling, long range, and low maintenance—make hydrogen SUVs an attractive alternative, especially for those who need the convenience of quick fueling. As infrastructure expands and green hydrogen becomes more available, the total cost of ownership will continue to improve.

For now, the market remains niche, but the foundation is being laid for broader adoption. Early adopters and eco-conscious drivers in supported regions like California can take advantage of incentives and enjoy a futuristic driving experience. As the technology matures, hydrogen fuel cell SUVs have the potential to play a key role in the transition to sustainable transportation.

The journey is just beginning, but the destination looks promising.

Frequently Asked Questions

How much does a hydrogen fuel cell SUV cost?

Hydrogen fuel cell SUVs like the Toyota Mirai and Hyundai Nexo start around $60,000–$70,000. Prices can be reduced with federal and state incentives, which may lower the effective cost by $10,000 or more.

Are hydrogen SUVs cheaper to maintain than gas vehicles?

Yes, hydrogen SUVs have fewer moving parts and require less maintenance. There’s no need for oil changes, exhaust repairs, or transmission work, leading to lower long-term costs.

Where can I buy a hydrogen fuel cell SUV?

Currently, hydrogen SUVs are primarily available in California, with limited availability in New York and Hawaii. Most sales are through certified dealerships in areas with hydrogen refueling stations.

How much does it cost to fuel a hydrogen SUV?

Hydrogen fuel costs about $12–$16 per kilogram. A typical fill-up (5–6 kg) costs $60–$90 and provides 300–400 miles of range, similar to premium gasoline.

Will hydrogen SUV prices go down in the future?

Yes, experts predict prices could drop 30–40% by 2030 due to improved technology, higher production volumes, and government support for clean energy.

Can I lease a hydrogen fuel cell SUV?

Yes, both Toyota and Hyundai offer lease programs with monthly payments around $350–$450. These leases often include free hydrogen fuel for the duration of the contract.