Hydrogen refueling stations are rapidly expanding as a key part of the clean energy transition. By 2025 and beyond, advancements in technology, government support, and private investment are making hydrogen a viable fuel for vehicles, trucks, and even industrial use.

Key Takeaways

- Global expansion is accelerating: Countries like Germany, Japan, and the U.S. are rapidly building hydrogen refueling networks to support zero-emission transportation.

- Green hydrogen is the future: Stations are increasingly using hydrogen produced from renewable energy, reducing carbon footprints significantly.

- Technology is improving fast: New compression, storage, and dispensing systems are making refueling faster, safer, and more efficient.

- Heavy-duty transport leads adoption: Trucks, buses, and logistics fleets are among the first to use hydrogen due to its high energy density and quick refueling.

- Public-private partnerships drive growth: Governments and companies are collaborating to fund and build infrastructure, reducing costs and risks.

- Challenges remain but are being addressed: High costs, limited stations, and hydrogen production methods are hurdles, but innovation and scale are helping overcome them.

- Consumer awareness is rising: As more hydrogen vehicles hit the road, public understanding and acceptance of hydrogen fuel are growing steadily.

📑 Table of Contents

The Rise of Hydrogen Refueling Stations in 2025

Imagine pulling up to a fueling station, not for gasoline or electricity, but for hydrogen. In just a few minutes, your vehicle is refueled and ready to go—emission-free. This isn’t science fiction. It’s becoming reality in 2025, as hydrogen refueling stations begin to dot highways, cities, and industrial zones around the world.

Hydrogen has long been hailed as a potential game-changer for clean transportation. Unlike battery-electric vehicles, which can take hours to charge, hydrogen fuel cell vehicles (FCEVs) refuel in under five minutes—similar to gasoline cars. And they produce only water vapor as exhaust. But for years, the biggest barrier wasn’t the vehicles—it was the lack of infrastructure. Without enough hydrogen refueling stations, consumers couldn’t rely on FCEVs for daily use.

That’s changing fast. In 2025, we’re seeing a major shift. Governments, automakers, and energy companies are investing billions into building hydrogen infrastructure. From California to Tokyo to Berlin, new stations are opening monthly. And the technology behind them is evolving just as quickly. Better storage, smarter dispensing, and greener production methods are making hydrogen not just possible, but practical.

Why Hydrogen Now?

So why the sudden push for hydrogen? The answer lies in the global race to cut carbon emissions. Transportation accounts for nearly a quarter of global CO₂ emissions, and while electric vehicles (EVs) are making strides, they’re not a perfect solution for everyone. Batteries are heavy, charging takes time, and mining lithium and cobalt raises environmental and ethical concerns.

Hydrogen, especially when produced using renewable energy—known as green hydrogen—offers a cleaner alternative. It’s especially useful for vehicles that need to travel long distances or carry heavy loads, like trucks, buses, and delivery vans. These vehicles can’t afford long charging stops, and hydrogen gives them the range and speed they need.

Plus, hydrogen isn’t just for cars. It’s being used in trains, ships, and even industrial machinery. As demand grows, so does the need for reliable refueling networks. That’s why 2025 is a pivotal year—many of the pilot projects and early investments are scaling up into real, usable infrastructure.

Global Progress: Where Hydrogen Stations Are Growing

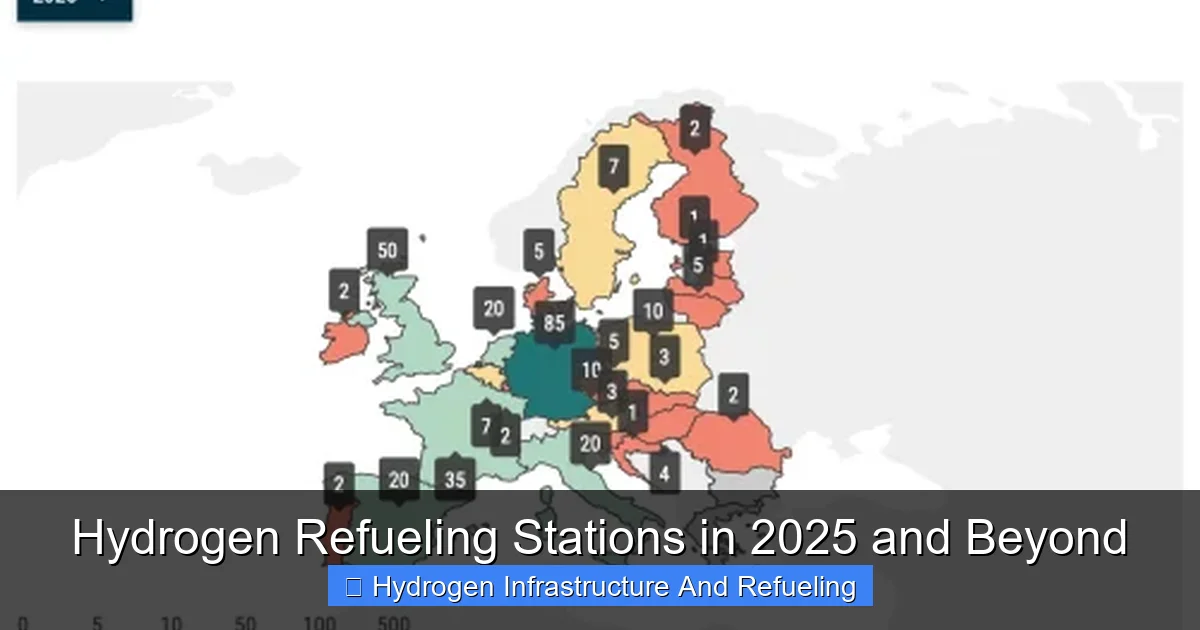

Visual guide about Hydrogen Refueling Stations in 2025 and Beyond

Image source: telematicswire.net

The growth of hydrogen refueling stations isn’t happening evenly across the globe. Some regions are leading the charge, while others are still in early planning stages. But the momentum is undeniable.

Europe: A Continental Commitment

Europe is arguably the most advanced region when it comes to hydrogen infrastructure. The European Union has made hydrogen a central part of its Green Deal, aiming for climate neutrality by 2050. Countries like Germany, France, and the Netherlands are investing heavily in hydrogen networks.

Germany, for example, opened its 100th hydrogen refueling station in early 2025. The H2 Mobility initiative, a partnership between automakers, energy firms, and the government, is on track to have 1,000 stations by 2030. These stations are strategically placed along major highways and in urban centers, making long-distance travel feasible.

France is following closely, with TotalEnergies and Air Liquide leading the charge. They’ve launched a network called “Hydrogène France,” targeting 300 stations by 2027. Meanwhile, the Netherlands is focusing on hydrogen for heavy transport, with plans to convert major freight corridors to hydrogen-powered trucks.

Asia: Japan and South Korea Lead the Way

Japan has been a pioneer in hydrogen technology for over a decade. Toyota’s Mirai, one of the first mass-produced hydrogen cars, hit the market in 2014. Since then, Japan has built over 160 hydrogen refueling stations, with plans to reach 320 by 2025.

The Japanese government supports this growth with subsidies and research funding. Companies like Toyota, Honda, and Kawasaki are not only building cars but also developing hydrogen production and distribution systems. Japan’s vision is bold: a “hydrogen society” where homes, vehicles, and industries all run on clean hydrogen.

South Korea is not far behind. Hyundai’s NEXO SUV is a popular FCEV, and the country has over 120 hydrogen stations. The government aims for 1,200 stations by 2040 and is promoting hydrogen use in buses and taxis. Seoul, in particular, has converted many of its public buses to hydrogen, reducing urban air pollution.

North America: The U.S. Picks Up Speed

The United States has been slower to adopt hydrogen, but that’s changing. California remains the epicenter of hydrogen infrastructure in the U.S., with over 60 stations operational in 2025. The state’s Zero Emission Vehicle (ZEV) mandate has pushed automakers and energy companies to invest in clean alternatives.

But the real game-changer is the federal government. The Inflation Reduction Act of 2022 included billions in tax credits for clean hydrogen production. This has sparked a wave of new projects. Companies like Plug Power, Nikola, and Cummins are building hydrogen production facilities and refueling networks, especially in the Midwest and along freight corridors.

Texas, for example, is emerging as a hydrogen hub. With its vast natural gas resources and renewable energy potential, the state is positioning itself as a leader in both blue hydrogen (from natural gas with carbon capture) and green hydrogen (from wind and solar).

How Hydrogen Refueling Stations Work

If you’ve never seen a hydrogen refueling station, it might seem mysterious. But the process is actually quite straightforward—once you understand the basics.

From Production to Pump

Hydrogen doesn’t come out of the ground like oil. It has to be produced. Most hydrogen today is made from natural gas in a process called steam methane reforming (SMR). This produces “gray hydrogen,” which still emits CO₂. But the future is in “green hydrogen,” made by splitting water into hydrogen and oxygen using renewable electricity—a process called electrolysis.

Once produced, hydrogen is compressed and stored at high pressure—usually around 700 bar (10,000 psi)—so it can be dispensed quickly. It’s then transported to refueling stations via tube trailers or pipelines, where it’s stored in on-site tanks.

The Refueling Process

When a driver pulls up to a hydrogen station, the process is similar to filling up with gasoline. The nozzle connects to the vehicle’s fuel port, and the system automatically checks for safety and compatibility. Then, hydrogen flows into the car’s tank in about 3 to 5 minutes—much faster than charging an EV.

Modern stations are designed with multiple safety features. Sensors detect leaks, automatic shut-off valves prevent overfilling, and the entire system is monitored remotely. Many stations also have backup power and emergency protocols in case of power outages or malfunctions.

Types of Stations

Not all hydrogen stations are the same. There are three main types:

- Retail stations: Located in cities or along highways, these serve individual consumers and fleets. They look like traditional gas stations but with hydrogen dispensers.

- Fleet stations: Built for specific customers, like bus depots or delivery companies. These are often larger and can refuel multiple vehicles at once.

- Mobile stations: Trailer-mounted units that can be moved to events, construction sites, or remote locations. Useful for temporary needs or pilot programs.

As technology improves, we’re also seeing the rise of “hybrid” stations that offer both hydrogen and electric charging, giving drivers more options.

Challenges Facing Hydrogen Infrastructure

Despite the progress, hydrogen refueling stations still face significant hurdles. Overcoming these challenges is key to widespread adoption.

High Costs

Building a hydrogen station is expensive. A single retail station can cost between $1.5 million and $3 million—far more than a gas station or EV charger. This includes the cost of compressors, storage tanks, dispensers, safety systems, and land.

The high cost is partly due to low demand. With only a few thousand hydrogen vehicles on the road in most regions, stations don’t get enough use to justify the investment. It’s a classic chicken-and-egg problem: people won’t buy hydrogen cars without stations, and companies won’t build stations without customers.

But costs are coming down. As more stations are built, manufacturers benefit from economies of scale. Newer, more efficient designs are also reducing expenses. For example, some stations now use modular components that can be assembled quickly and expanded as demand grows.

Limited Production and Distribution

Another major issue is getting hydrogen to the stations. Unlike gasoline, which has a vast pipeline and tanker network, hydrogen distribution is still in its infancy.

Transporting hydrogen is tricky. It’s a very light gas, so it takes up a lot of space. It can also embrittle metals, making pipelines and tanks more prone to leaks. Most hydrogen today is moved by truck in compressed form, which is expensive and energy-intensive.

Pipelines are a better long-term solution, but building them requires massive investment. A few pilot projects are underway—like the HyDeal Ambition initiative in Spain, which aims to create a solar-powered hydrogen pipeline network—but widespread adoption is still years away.

Energy Efficiency Concerns

Hydrogen isn’t the most efficient fuel. It takes a lot of energy to produce, compress, transport, and convert back into electricity in a fuel cell. Some critics argue that it’s better to use that electricity directly in batteries.

For example, producing green hydrogen from solar power, then using it in a car, is only about 30% efficient. In contrast, charging an EV directly from solar is over 70% efficient. That’s a big difference.

But hydrogen has advantages in certain applications. For long-haul trucks, ships, or planes, batteries are too heavy and take too long to charge. Hydrogen’s high energy density makes it a better fit. And as renewable energy becomes cheaper, the efficiency gap narrows.

Public Perception and Safety

Hydrogen has a reputation for being dangerous—thanks in part to the Hindenburg disaster. But modern hydrogen systems are much safer. Hydrogen is lighter than air, so it disperses quickly if leaked. It also has a wide flammability range, but strict safety standards and sensors minimize risks.

Still, public education is needed. Many people don’t understand how hydrogen works or why it’s safe. Automakers and station operators are working to build trust through transparency, training, and community outreach.

The Role of Policy and Investment

Government policy and private investment are the driving forces behind the hydrogen boom. Without them, progress would be much slower.

Government Support

Countries around the world are offering incentives to build hydrogen infrastructure. These include:

- Tax credits: The U.S. offers up to $3 per kilogram of clean hydrogen produced, making green hydrogen cost-competitive.

- Grants and loans: The European Union’s Innovation Fund provides billions for hydrogen projects.

- Mandates and targets: California requires a certain number of hydrogen stations, and Japan has national hydrogen roadmaps.

These policies reduce financial risk for companies and encourage innovation. They also signal long-term commitment, which helps attract private investment.

Private Sector Leadership

Big companies are stepping up. Automakers like Toyota, Hyundai, and BMW are investing in hydrogen vehicles and infrastructure. Energy giants like Shell, BP, and Air Liquide are building stations and production facilities.

Startups are also playing a key role. Companies like Plug Power and Bloom Energy are developing new electrolyzers and fuel cells. Nikola is building hydrogen trucks and refueling networks. These innovators are pushing the boundaries of what’s possible.

Partnerships are common. For example, Toyota and Shell are co-developing hydrogen stations in California. Hyundai and Ineos are working on hydrogen for heavy industry. These collaborations combine expertise and resources, speeding up deployment.

The Future: What’s Next for Hydrogen Stations?

Looking beyond 2025, the future of hydrogen refueling stations is bright—but it depends on continued progress.

Scaling Up

The next decade will see a massive scale-up. By 2030, experts predict over 10,000 hydrogen stations worldwide. Most will be in urban areas and along major transport routes. Some countries, like Germany and Japan, aim for near-complete coverage.

Automation will also improve. Future stations may use AI to predict demand, optimize refueling times, and perform remote maintenance. Some could even be unmanned, with drivers paying via app.

Integration with Renewable Energy

The ideal hydrogen station will be powered by on-site solar or wind. Excess renewable energy can be used to produce hydrogen during the day, which is stored and dispensed at night. This creates a closed-loop system that’s both clean and resilient.

We’re already seeing this in pilot projects. In Australia, the HySupply project uses solar power to produce hydrogen for transport. In Iceland, geothermal energy fuels hydrogen production. These models could become standard.

Hydrogen for More Than Cars

While passenger vehicles get most of the attention, the real growth may come from other sectors. Hydrogen is ideal for:

- Trucks: Long-haul freight needs quick refueling and long range.

- Buses: Cities are converting public transit to zero-emission options.

- Trains: Hydrogen-powered trains are already running in Germany and the UK.

- Shipping and aviation: These industries are exploring hydrogen as a way to decarbonize.

As these sectors adopt hydrogen, demand for refueling infrastructure will explode.

Global Collaboration

The hydrogen economy won’t succeed in isolation. Countries will need to share technology, standards, and best practices. International agreements, like the Hydrogen Council and the Clean Energy Ministerial, are helping coordinate efforts.

Trade in hydrogen is also emerging. Australia, for example, is exporting green hydrogen to Japan. Chile and Saudi Arabia are developing hydrogen export hubs. This global market could lower costs and increase supply.

Conclusion

Hydrogen refueling stations in 2025 and beyond represent a critical step toward a cleaner, more sustainable future. While challenges remain—high costs, limited infrastructure, and production methods—the momentum is undeniable. With strong government support, private investment, and technological innovation, hydrogen is poised to play a major role in decarbonizing transportation and industry.

The journey isn’t over, but the path is clear. As more stations open, more vehicles hit the road, and production becomes greener, hydrogen will move from niche to mainstream. For drivers, fleet operators, and policymakers, now is the time to pay attention. The hydrogen revolution isn’t coming—it’s already here.

Frequently Asked Questions

How many hydrogen refueling stations are there in 2025?

As of 2025, there are over 1,200 hydrogen refueling stations worldwide, with the majority in Europe, Japan, South Korea, and California. This number is expected to grow rapidly in the coming years.

Are hydrogen refueling stations safe?

Yes, hydrogen refueling stations are designed with multiple safety features, including leak detection, automatic shut-off valves, and remote monitoring. Hydrogen disperses quickly if released, reducing fire risk.

How long does it take to refuel a hydrogen car?

Refueling a hydrogen fuel cell vehicle takes about 3 to 5 minutes, similar to filling up a gasoline car and much faster than charging an electric vehicle.

What is green hydrogen?

Green hydrogen is produced by splitting water into hydrogen and oxygen using renewable electricity, such as wind or solar. It’s considered the cleanest form of hydrogen with zero carbon emissions.

Can I use a hydrogen station if I don’t have a hydrogen car?

No, hydrogen stations are designed specifically for hydrogen fuel cell vehicles. They are not compatible with gasoline, diesel, or battery-electric vehicles.

Will hydrogen stations replace gas stations?

Not entirely. Hydrogen will likely complement electric and gasoline vehicles, especially for heavy-duty transport and long-distance travel. A mix of clean energy options is expected in the future.